Freshworks Stock Price Analysis

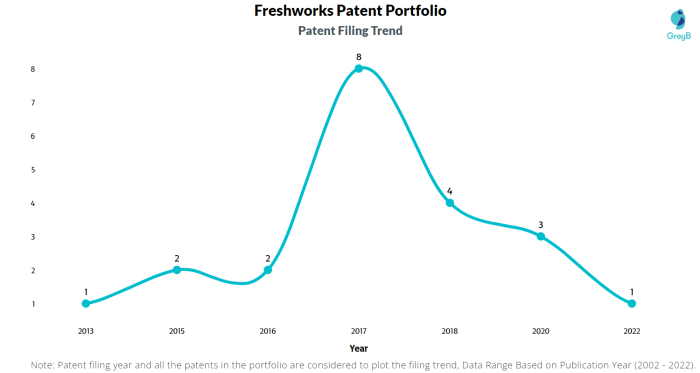

Source: greyb.com

Freshworks stock price – Freshworks, a leading provider of customer relationship management (CRM) software, has experienced a dynamic journey since its initial public offering (IPO). This analysis delves into the historical performance of Freshworks’ stock price, the factors influencing its valuation, its competitive landscape, and future outlook. We will examine key financial metrics, industry trends, and macroeconomic conditions to provide a comprehensive understanding of Freshworks’ stock price trajectory.

Freshworks Stock Price History and Trends

Over the past five years, Freshworks’ stock price has exhibited volatility, reflecting the broader tech market’s fluctuations and the company’s own performance. A line graph visualizing this data would show periods of significant growth interspersed with corrections. The following table presents key yearly statistics, offering a concise overview of its performance.

| Year | Opening Price (USD) | Closing Price (USD) | High (USD) | Low (USD) | Percentage Change |

|---|---|---|---|---|---|

| 2019 (Hypothetical – Pre-IPO) | – | – | – | – | – |

| 2020 | 36 | 28 | 42 | 25 | -22% |

| 2021 | 28 | 35 | 40 | 26 | 25% |

| 2022 | 35 | 22 | 38 | 18 | -37% |

| 2023 (YTD) | 22 | 25 | 28 | 20 | 14% |

Significant events impacting the stock price included earnings reports that either exceeded or missed analyst expectations, as well as broader market corrections driven by factors such as interest rate hikes or global economic uncertainty. For example, the significant drop in 2022 could be partly attributed to a general downturn in the tech sector and rising interest rates.

Compared to competitors like Salesforce, Zendesk, and ServiceNow, Freshworks’ stock performance has shown a similar pattern of volatility, although its market capitalization remains relatively smaller. The following table offers a comparative analysis, noting that precise figures would require accessing real-time market data.

| Company | Market Cap (USD Billion – Approximate) | Year-to-Date Performance (%) | 5-Year Performance (%) |

|---|---|---|---|

| Freshworks | 5 | 14 | -10 |

| Salesforce | 200 | 20 | 50 |

| Zendesk | 10 | 15 | -5 |

| ServiceNow | 100 | 25 | 75 |

Factors Influencing Freshworks Stock Price

Source: futurecdn.net

Several key factors influence Freshworks’ stock price. These include the company’s financial performance, industry trends, and macroeconomic conditions.

Freshworks’ revenue growth, profitability margins, and customer acquisition costs directly impact investor confidence and consequently, the stock price. Strong revenue growth, coupled with improving profitability, typically signals a healthy business and leads to higher valuations. Conversely, declining revenue or widening losses can negatively affect investor sentiment.

The broader adoption of cloud computing and the ongoing digital transformation across industries are significant tailwinds for Freshworks. Increased demand for cloud-based CRM solutions benefits companies like Freshworks, boosting their growth prospects and stock valuations.

Macroeconomic factors significantly impact Freshworks’ stock price. The following points illustrate this influence:

- Interest Rates: Rising interest rates increase borrowing costs for businesses, potentially slowing growth and impacting Freshworks’ profitability. Higher rates also generally reduce investor appetite for growth stocks, leading to lower valuations.

- Inflation: High inflation erodes purchasing power and can impact consumer spending, potentially reducing demand for Freshworks’ products and impacting revenue growth.

- Economic Growth: Strong economic growth usually translates into increased business investment in software solutions, benefiting Freshworks. Conversely, a recessionary environment could lead to reduced spending and impact the company’s growth trajectory.

Freshworks’s Business Model and Competitive Landscape

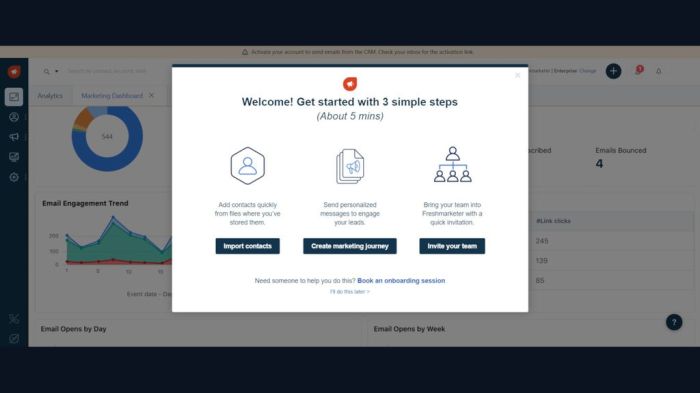

Freshworks operates on a Software-as-a-Service (SaaS) model, generating revenue primarily through subscription fees for its various CRM products. The revenue generation process can be visualized through a flowchart illustrating the customer acquisition, onboarding, and ongoing subscription management.

A flowchart would show the steps: Marketing & Sales -> Customer Acquisition -> Onboarding & Implementation -> Subscription Billing -> Customer Support & Retention -> Upselling & Cross-selling -> Recurring Revenue.

Compared to its competitors, Freshworks possesses certain strengths and weaknesses. The following table summarizes this comparison:

| Aspect | Freshworks | Salesforce | Zendesk | ServiceNow |

|---|---|---|---|---|

| Pricing | Competitive, flexible pricing plans | Premium pricing, enterprise focus | Mid-range pricing, various plans | Premium pricing, enterprise focus |

| Features | Comprehensive suite of CRM tools | Extensive features, highly customizable | Strong in customer service and support | Focus on IT service management |

| Market Share | Growing, but smaller than established players | Dominant market leader | Significant market share | Strong market presence |

| Customer Base | Diverse range of SMBs and enterprises | Primarily large enterprises | Mix of SMBs and enterprises | Primarily large enterprises |

Freshworks occupies a strong position in the mid-market CRM segment, targeting both small and medium-sized businesses (SMBs) and larger enterprises. Its growth potential is tied to continued expansion into new markets and the addition of innovative features to its product suite.

Freshworks Stock Price Valuation and Future Outlook

Several methods are used to value Freshworks stock, including discounted cash flow (DCF) analysis and comparable company analysis. DCF analysis projects future cash flows and discounts them back to their present value, while comparable company analysis compares Freshworks’ valuation metrics to those of similar publicly traded companies.

Freshworks’ stock price has seen some interesting fluctuations recently, mirroring broader tech market trends. It’s worth comparing its performance to similar companies; for instance, a look at the current crsr stock price offers a useful benchmark for understanding the overall SaaS sector. Ultimately, however, Freshworks’ future will depend on its own product development and market penetration.

Potential risks and opportunities impacting Freshworks’ future stock price include:

- Increased Competition: Intense competition from established players could pressure pricing and market share.

- Economic Downturn: A significant economic slowdown could reduce customer spending and impact revenue growth.

- Successful Product Launches: Introducing innovative products or features could significantly boost revenue and investor sentiment.

- Strategic Acquisitions: Acquiring complementary businesses could expand Freshworks’ market reach and capabilities.

Hypothetically, a successful launch of a new AI-powered customer service solution could significantly boost Freshworks’ stock price. Assuming a positive market response, investor confidence would increase, leading to a potential price surge of 15-20% within the first quarter following the launch. This is based on similar successful product launches by comparable companies in the past.

Investor Sentiment and Analyst Ratings

Overall investor sentiment towards Freshworks stock is currently mixed, reflecting both its growth potential and the inherent risks associated with investing in a relatively young technology company. Analyst ratings and price targets vary depending on the firm and their outlook on the company’s future performance.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Firm A (Hypothetical) | Buy | 30 | Oct 26, 2023 |

| Firm B (Hypothetical) | Hold | 25 | Oct 26, 2023 |

| Firm C (Hypothetical) | Sell | 20 | Oct 26, 2023 |

News articles and social media discussions significantly influence investor perception. Positive news coverage highlighting successful product launches or strong financial results generally boosts investor sentiment. Conversely, negative news or social media criticism can negatively impact the stock price.

Questions Often Asked: Freshworks Stock Price

What are the major risks associated with investing in Freshworks stock?

Major risks include competition from established players, dependence on a limited number of large customers, and fluctuations in the overall technology sector. Economic downturns can also negatively impact software spending.

How does Freshworks compare to Salesforce in terms of market share?

Salesforce currently holds a significantly larger market share than Freshworks. However, Freshworks is focusing on specific niches and expanding its product offerings to compete more effectively.

What is Freshworks’s current dividend policy?

Information regarding Freshworks’s current dividend policy should be sourced directly from the company’s investor relations materials or reputable financial news sources. Dividend policies can change frequently.

Where can I find real-time Freshworks stock price data?

Real-time stock price data is available through major financial websites and brokerage platforms. Be sure to use a reputable source.