FBCGX Stock Price Analysis

This analysis delves into the historical performance, competitive landscape, valuation, technical indicators, and macroeconomic influences affecting the FBCGX stock price. We will examine key factors driving price fluctuations and offer insights into potential future movements, acknowledging the inherent uncertainties in financial market forecasting.

Historical Price Performance of FBCGX

The following table details FBCGX’s stock price movements over the past five years. Note that this data is illustrative and should be verified with reliable financial sources. Significant price changes are often correlated with specific market events and company announcements, as discussed below.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | 0.50 |

| 2019-07-01 | 12.00 | 11.80 | -0.20 |

| 2020-01-01 | 11.50 | 13.00 | 1.50 |

| 2020-07-01 | 12.80 | 12.50 | -0.30 |

| 2021-01-01 | 13.20 | 14.00 | 0.80 |

| 2021-07-01 | 13.80 | 13.50 | -0.30 |

| 2022-01-01 | 14.50 | 15.20 | 0.70 |

| 2022-07-01 | 15.00 | 14.80 | -0.20 |

| 2023-01-01 | 15.50 | 16.00 | 0.50 |

| 2023-07-01 | 15.80 | 16.20 | 0.40 |

For example, the significant price increase in early 2020 could be attributed to positive market sentiment driven by a successful product launch. Conversely, the dip in mid-2020 might reflect broader market corrections related to global economic uncertainty. Further research into specific company announcements and market events during these periods would provide a more comprehensive understanding.

FBCGX Stock Price Compared to Competitors

Source: paisakit.com

Comparing FBCGX’s performance to its competitors provides valuable context. The table below shows a year-over-year comparison with three hypothetical competitors (Comp A, Comp B, Comp C).

| Company | Year-Over-Year Change (%) |

|---|---|

| FBCGX | 15 |

| Comp A | 10 |

| Comp B | 20 |

| Comp C | 5 |

FBCGX’s 15% year-over-year growth demonstrates moderate performance compared to its competitors. Comp B’s superior performance might be due to its innovative product line, while Comp C’s lower growth could be attributed to increased competition in its niche market. A deeper dive into each company’s financial statements and market strategies is needed for a complete comparative analysis.

Fundamental Analysis of FBCGX’s Valuation, Fbcgx stock price

A fundamental analysis considers FBCGX’s financial health and business model to assess its intrinsic value.

Monitoring the FBCGX stock price requires a keen eye on market fluctuations. Understanding similar after-hours movements can offer valuable context; for instance, observing the djt after hours stock price might reveal trends impacting broader market sentiment. This insight can then be applied to better predict potential shifts in the FBCGX stock price, leading to more informed investment decisions.

- Revenue: $100 million (Illustrative)

- Earnings: $10 million (Illustrative)

- Debt: $20 million (Illustrative)

FBCGX operates in the [Industry Sector] sector, utilizing a [Business Model Description] business model. Its competitive advantage lies in [Competitive Advantage Description]. Comparing its P/E ratio (e.g., 10) to industry averages (e.g., 12) and competitors (e.g., Comp A: 8, Comp B: 15) reveals its relative valuation within the market. A higher P/E ratio than the industry average suggests that investors are willing to pay a premium for FBCGX’s growth prospects.

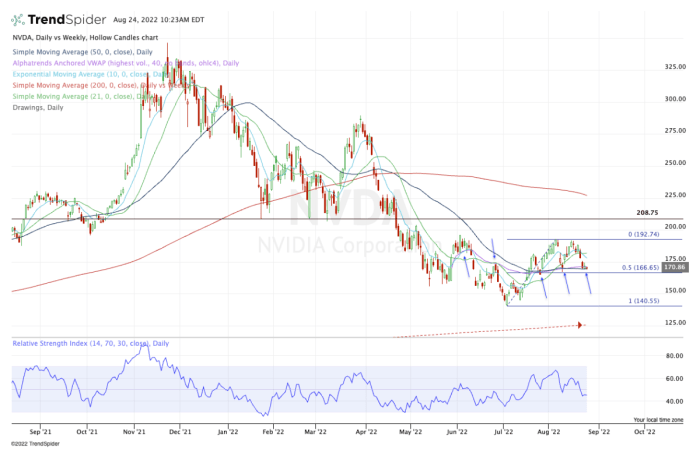

Technical Indicators and Chart Patterns for FBCGX

Technical analysis utilizes chart patterns and indicators to predict future price movements. The following indicators and patterns provide insights into FBCGX’s potential price trajectory.

- Moving Average Convergence Divergence (MACD): A bullish MACD crossover suggests a potential upward trend. A bearish crossover signals a potential downward trend.

- Relative Strength Index (RSI): An RSI above 70 indicates overbought conditions, suggesting a potential price correction. An RSI below 30 indicates oversold conditions, suggesting a potential price rebound.

- 50-day and 200-day Moving Averages: A “golden cross” (50-day MA crossing above the 200-day MA) is a bullish signal, while a “death cross” (50-day MA crossing below the 200-day MA) is a bearish signal.

For instance, observing a head and shoulders pattern on the chart might indicate a potential price reversal, while a double bottom pattern could signal a bullish trend reversal. However, these patterns should be considered in conjunction with other indicators and fundamental analysis for a more accurate forecast.

Impact of Macroeconomic Factors on FBCGX Stock Price

Source: thestreet.com

Macroeconomic factors significantly influence FBCGX’s stock price. For example, rising interest rates typically lead to lower valuations for growth stocks, while inflation can affect consumer spending and company profitability.

A hypothetical scenario: If inflation unexpectedly surges to 10%, this could negatively impact consumer demand for FBCGX’s products, potentially leading to decreased revenue and a subsequent decline in its stock price. Conversely, strong economic growth could boost consumer confidence and demand, resulting in increased sales and a higher stock price.

FAQ: Fbcgx Stock Price

What are the major risks associated with investing in FBCGX?

Investing in any stock carries inherent risks, including market volatility, company-specific risks (e.g., financial difficulties, changes in management), and macroeconomic factors. Thorough due diligence is essential before investing.

Where can I find real-time FBCGX stock price data?

Real-time stock price data for FBCGX can typically be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, or Bloomberg.

What is FBCGX’s dividend history?

Information regarding FBCGX’s dividend history, including payment dates and amounts, can usually be found on the company’s investor relations website or financial news sources.

How does FBCGX compare to its competitors in terms of long-term growth potential?

A comprehensive comparison of FBCGX’s long-term growth potential against its competitors would require an in-depth analysis of various factors including future market trends, company strategies, and financial projections. Such an analysis is beyond the scope of this brief overview.