Facebook Stock Price History

Facebook stock price history – Facebook, now Meta, has experienced a rollercoaster ride since its initial public offering (IPO). Understanding its stock price history requires analyzing various factors, from its initial growth trajectory to the impact of major events and competitive pressures. This analysis will explore the key trends and influences shaping Facebook’s stock price performance.

Facebook Stock Price Trends Over Time

Since its IPO in 2012, Facebook’s stock price has shown periods of significant growth interspersed with notable declines. The early years following the IPO witnessed a steady upward trend, fueled by increasing user adoption and expanding advertising revenue. However, subsequent years have seen volatility driven by various internal and external factors.

| Date Range | Starting Price | Ending Price | Percentage Change |

|---|---|---|---|

| May 2012 – July 2012 | $38 | $28 | -26% |

| July 2012 – July 2018 | $28 | $217 | 675% |

| July 2018 – July 2022 | $217 | $150 | -31% |

The most substantial price increases were driven by consistently strong revenue growth, fueled by increasing advertising revenue and user engagement. Conversely, significant price decreases were often linked to regulatory scrutiny, privacy concerns, and competition from other social media platforms.

Impact of Major Events on Stock Price

Major news events have significantly impacted Facebook’s stock price. Both positive and negative news have resulted in considerable market reactions, highlighting the company’s sensitivity to public perception and regulatory changes.

- The Cambridge Analytica scandal in 2018 led to a sharp decline in stock price due to concerns over data privacy and regulatory repercussions.

- The launch of new products like Instagram Reels and Facebook Marketplace has generally been met with positive market response, boosting stock price.

- Increased regulatory scrutiny regarding antitrust concerns and data privacy have often resulted in negative market reactions, leading to price drops.

Positive news generally leads to increased investor confidence and higher trading volume, pushing the stock price upwards. Conversely, negative news often triggers selling pressure, leading to decreased trading volume and lower stock prices.

Comparison with Competitor Stock Prices, Facebook stock price history

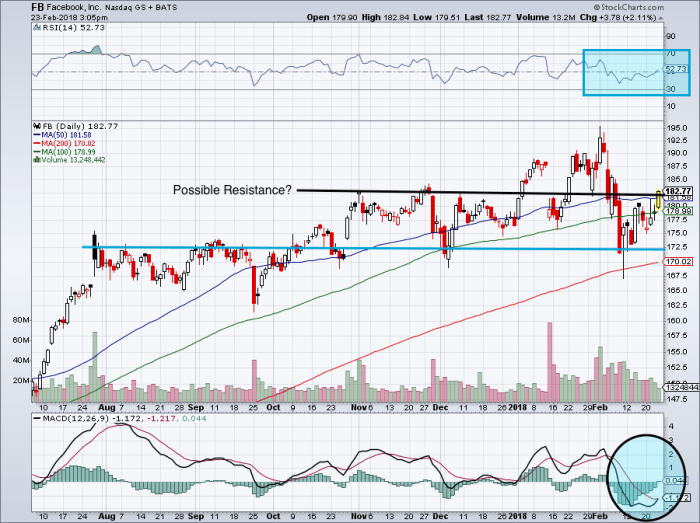

Source: investorplace.com

Comparing Facebook’s stock price performance to its main competitors provides valuable insights into its relative market position and competitive strengths. This comparison considers factors such as average price and price volatility over specific periods.

| Company | Date Range | Average Price | Price Volatility (Standard Deviation) |

|---|---|---|---|

| Facebook (Meta) | 2022 | $175 | $25 |

| Google (Alphabet) | 2022 | $2500 | $150 |

| Twitter (X) | 2022 | $45 | $10 |

This comparison reveals that while Google maintains a significantly higher average price, reflecting its larger market capitalization and broader business model, Facebook’s price volatility is comparable to that of Twitter, suggesting similar market sensitivity to news and events.

Financial Performance and Stock Price Correlation

A strong correlation exists between Facebook’s financial reports (revenue, earnings, user growth) and its stock price movements. Positive financial results generally lead to increased investor confidence and higher stock prices, while negative results can have the opposite effect.

A line graph could visually represent this correlation. The x-axis would represent time (e.g., quarterly or annually), and the y-axis would show both Facebook’s stock price and key financial metrics (revenue, net income) on separate lines. A positive correlation would be shown by both lines generally moving in the same direction.

Strong revenue growth and increased profitability typically translate into higher investor expectations and a higher stock valuation. Conversely, declining revenue or lower profitability often leads to decreased investor confidence and lower stock prices.

Key Indicators and Stock Price Prediction (Avoid Explicit Prediction)

Source: businessinsider.com

Several key financial indicators significantly influence Facebook’s stock price. Understanding these indicators can inform investment strategies, though it’s crucial to remember that past performance does not guarantee future results.

Analyzing Facebook’s stock price history reveals interesting patterns of growth and fluctuation. Understanding these trends often involves comparing performance against similar companies; for instance, one might examine the cour stock price to gain comparative insight. Returning to Facebook, however, its long-term trajectory remains a key factor for investors considering its future prospects.

- P/E Ratio: A high P/E ratio suggests investors expect strong future growth. Historically, Facebook’s P/E ratio has fluctuated with its growth prospects and market sentiment.

- Revenue Growth: Consistent revenue growth is a key driver of stock price increases. Periods of slower revenue growth have often been accompanied by stock price declines.

- User Growth: The number of daily and monthly active users directly impacts advertising revenue and therefore, stock price.

Analyzing these indicators alongside broader market trends and economic factors can provide a more comprehensive view of the potential for future stock price movements. However, making definitive predictions remains challenging.

Investor Sentiment and Stock Price

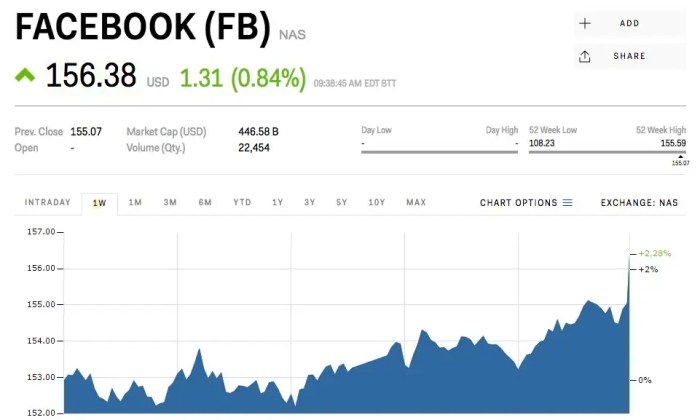

Source: businessinsider.com

Investor sentiment significantly impacts Facebook’s stock price. Positive sentiment leads to increased buying pressure and higher prices, while negative sentiment leads to selling pressure and lower prices.

Media coverage, analyst ratings, and social media discussions all influence investor sentiment. Positive media coverage and strong analyst ratings often boost investor confidence, leading to higher stock prices. Conversely, negative media coverage and downgraded ratings can trigger selling pressure and lower prices.

Investor sentiment translates into buying and selling pressure through various mechanisms. Positive news and sentiment encourage investors to buy shares, increasing demand and driving up the price. Conversely, negative news and sentiment encourage selling, increasing supply and pushing the price down.

Questions and Answers: Facebook Stock Price History

What is the current Facebook (Meta) stock price?

The current price fluctuates constantly. You should consult a real-time financial website for the most up-to-date information.

How can I invest in Facebook (Meta) stock?

You can typically buy Facebook (Meta) stock through a brokerage account. Research different brokers and choose one that suits your needs and investment strategy.

What are the risks associated with investing in Facebook (Meta) stock?

Like any stock, investing in Facebook (Meta) carries inherent risks. Market volatility, regulatory changes, and company performance all impact stock price, leading to potential losses.

Where can I find historical Facebook (Meta) stock data?

Many financial websites, such as Yahoo Finance, Google Finance, and others, provide detailed historical stock data for Facebook (Meta).