Understanding the Dow Jones Industrial Average: Dow Stock Market Price

Dow stock market price – The Dow Jones Industrial Average (DJIA), often referred to simply as “the Dow,” is a stock market index that tracks the performance of 30 large, publicly traded companies in the United States. It’s one of the oldest and most widely followed stock market indices globally, providing a snapshot of the overall health of the American economy.

Composition of the DJIA

The DJIA comprises 30 blue-chip companies representing a variety of sectors, including technology, finance, consumer goods, and industrials. These companies are selected by the S&P Dow Jones Indices, considering factors like market capitalization, liquidity, and overall representation of the US economy. The composition is periodically reviewed and adjusted to reflect changes in the economic landscape.

History and Evolution of the DJIA

The DJIA’s history dates back to 1896 when Charles Dow and Edward Jones created the index with just 12 companies. Over time, the index has evolved, with companies being added and removed to better represent the changing economic landscape. The initial focus was heavily industrial, reflecting the era’s dominant sectors, but today it reflects a broader, more diversified economy.

Significant milestones include the addition of companies from the technology and consumer services sectors, reflecting the shifting economic dominance.

Weighting Methodology of the DJIA

Source: togatimes.com

Unlike many other indices that use market-capitalization weighting, the DJIA uses a price-weighted methodology. This means that the influence of each company on the index’s overall value is directly proportional to its share price. A higher share price contributes more to the index’s movement than a lower share price, regardless of the company’s market capitalization. This can lead to situations where a smaller company with a high share price has a disproportionately large influence compared to a larger company with a lower share price.

Top 10 Companies by Weighting in the DJIA

The weighting of companies in the DJIA fluctuates constantly. The following table provides a snapshot of the top 10 companies by weighting (Note: This is a hypothetical example and should not be taken as current market data. Actual rankings change frequently.):

| Rank | Company | Weighting (Hypothetical) | Sector |

|---|---|---|---|

| 1 | Company A | 12% | Technology |

| 2 | Company B | 10% | Finance |

| 3 | Company C | 9% | Technology |

| 4 | Company D | 8% | Consumer Goods |

| 5 | Company E | 7% | Industrials |

| 6 | Company F | 6% | Healthcare |

| 7 | Company G | 5% | Energy |

| 8 | Company H | 4% | Technology |

| 9 | Company I | 4% | Financials |

| 10 | Company J | 3% | Consumer Staples |

Factors Influencing Dow Stock Market Prices

Numerous factors, both domestic and international, influence the price movements of the Dow Jones Industrial Average. Understanding these factors is crucial for investors seeking to navigate the market effectively.

Macroeconomic Factors Impacting DJIA Prices

Macroeconomic conditions significantly impact the DJIA. Interest rate changes by the Federal Reserve influence borrowing costs for businesses and consumers, affecting investment and spending. Inflation erodes purchasing power and can lead to uncertainty in the market. Economic growth, measured by GDP, reflects the overall health of the economy and its potential for future growth, directly influencing investor confidence.

Influence of Geopolitical Events on DJIA Performance

Source: investorplace.com

Geopolitical events, such as international conflicts, trade wars, and political instability in major economies, can create significant uncertainty and volatility in the market. These events often lead to short-term market corrections as investors react to the perceived risk. For example, the Russian invasion of Ukraine in 2022 caused significant market volatility.

Role of Investor Sentiment and Market Psychology

Investor sentiment and market psychology play a significant role in shaping market trends. Periods of optimism and confidence often lead to upward price movements, while fear and uncertainty can trigger sell-offs. Market sentiment is often influenced by news events, economic data, and overall market trends.

Impact of Short-Term and Long-Term Trends

Short-term trends in the DJIA are often driven by news events, investor sentiment, and speculation. These fluctuations can be dramatic but are generally less indicative of long-term market direction. Long-term trends, however, reflect the underlying economic growth, technological advancements, and overall market health. Long-term trends are often more reliable indicators of the market’s direction.

Analyzing Historical Dow Stock Market Price Data

Analyzing historical DJIA data provides valuable insights into market behavior and can inform investment strategies. Examining past price movements, trends, and volatility helps investors understand the potential risks and rewards associated with investing in the Dow.

Significant Historical Price Movements and Their Causes

The history of the DJIA is marked by periods of both significant gains and sharp declines. The 1929 crash, triggered by overvalued stocks and economic instability, remains a stark reminder of market volatility. Conversely, periods of strong economic growth and technological innovation, like the dot-com boom of the late 1990s, have led to significant market rallies. The 2008 financial crisis, caused by the subprime mortgage crisis, resulted in a substantial market downturn.

Each of these periods offers valuable lessons about market dynamics and risk management.

Historical Data Demonstrating Trends Over Different Time Periods

Analyzing historical data across different timeframes reveals varying trends. A 5-year view might show short-term fluctuations, while a 10-year perspective reveals longer-term growth patterns. A 20-year analysis reveals the long-term trend of the market and the impact of major economic events.

| Time Period | Average Annual Return (Hypothetical) | Volatility (Hypothetical) | Significant Events |

|---|---|---|---|

| 5 Years | 7% | High | Trade wars, interest rate hikes |

| 10 Years | 9% | Medium | Global economic expansion, technological advancements |

| 20 Years | 6% | Low | Multiple economic cycles, major technological shifts |

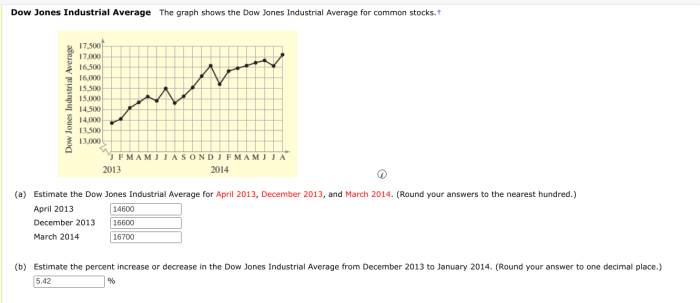

Visual Representation of Historical Volatility

A visual representation of historical DJIA volatility would show periods of relatively calm price movements interspersed with periods of sharp increases and decreases. The magnitude and frequency of these swings would illustrate the risk inherent in investing in the Dow. Periods of high volatility are often associated with economic uncertainty or major news events. Conversely, periods of low volatility suggest a more stable market environment.

Interpreting Different Types of Charts

Source: cheggcdn.com

Line charts illustrate the overall trend of the DJIA over time. Bar charts highlight daily or weekly price changes. Candlestick charts provide a more detailed picture of price movements, including opening, closing, high, and low prices for a given period, aiding in identifying potential reversal points or continuation patterns.

Predicting Future Dow Stock Market Prices

Accurately predicting future Dow stock market prices is inherently challenging, if not impossible. While various models and techniques exist, they offer probabilities and potential scenarios rather than definitive predictions.

Monitoring the Dow stock market price requires a keen eye on various economic indicators. Understanding individual stock performance, however, can also offer valuable insights; for example, checking out the crkn stock price prediction might reveal trends that foreshadow broader market shifts. Ultimately, both individual stock analysis and overall market indices like the Dow are crucial for a comprehensive investment strategy.

Limitations of Predicting Stock Market Prices

Numerous unpredictable factors influence market movements, making precise predictions highly unlikely. Unexpected geopolitical events, economic shocks, and shifts in investor sentiment can significantly impact market performance. Even sophisticated models are limited by their reliance on historical data and their inability to account for unforeseen circumstances.

Different Forecasting Models Used for the DJIA

Several forecasting models attempt to predict future DJIA prices. These include time series analysis, which identifies patterns in historical data; econometric models, which incorporate macroeconomic variables; and machine learning algorithms, which identify complex relationships in large datasets. Each model has its strengths and limitations, and the accuracy of predictions varies significantly.

Use of Technical Indicators in Price Prediction

Technical analysis utilizes charts and indicators to identify potential price trends and patterns. Indicators such as moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence) provide signals that can be used to inform trading decisions. However, technical indicators are not foolproof and should be used in conjunction with other forms of analysis.

Fundamental Analysis and its Application to DJIA Stock Prediction

Fundamental analysis evaluates the intrinsic value of companies within the DJIA by examining their financial statements, business models, and competitive landscapes. By assessing the underlying strength of individual companies, investors can make informed decisions about their long-term investment potential. However, fundamental analysis is not always a precise predictor of short-term price movements.

Impact of Individual Dow Stocks on the Overall Index

The performance of individual Dow components significantly influences the overall index’s movement. The weighting methodology means that companies with higher share prices have a greater impact on the index’s daily fluctuations.

Stocks with the Largest Impact on the DJIA

Companies with the highest share prices typically exert the most significant influence on the DJIA’s daily movements. Changes in their share prices have a proportionally larger effect on the index’s overall value than companies with lower share prices. This is a direct consequence of the price-weighted methodology.

How Individual Stock Performance Influences the Overall Index

A significant price increase in a high-weighted Dow component will generally push the index upward, while a sharp decline will exert downward pressure. Conversely, price changes in lower-weighted companies have a less pronounced effect on the overall index. The cumulative effect of all 30 components determines the index’s daily performance.

Relative Influence of Different Sectors Within the DJIA

Different sectors within the DJIA exhibit varying degrees of influence depending on their representation and the prevailing economic conditions. For example, during periods of economic uncertainty, the financial sector might have a disproportionately large impact, while during periods of technological advancement, the technology sector could dominate the index’s movement.

Hypothetical Scenario Demonstrating Impact of a Significant Price Change

Imagine a hypothetical scenario where Company X, a high-weighted technology company in the DJIA, experiences a 10% price drop due to disappointing earnings. Given its significant weighting, this could trigger a considerable decline in the overall DJIA, even if other companies are performing well. This illustrates the impact of individual components on the overall index.

Strategies for Investing in the Dow

Several strategies exist for investing in the Dow, each with its own set of risks and rewards. Choosing the right approach depends on an investor’s risk tolerance, investment horizon, and financial goals.

Different Investment Strategies for the Dow, Dow stock market price

Investors can access the Dow through various strategies. Index funds provide broad exposure to all 30 components, mirroring the index’s performance. Exchange-Traded Funds (ETFs) offer similar diversification but can be traded throughout the day like individual stocks. Investing in individual Dow stocks offers the potential for higher returns but also carries higher risk.

Risks and Rewards Associated with Each Strategy

Index funds and ETFs offer diversification and lower risk compared to investing in individual stocks. However, their returns are generally limited to the overall index performance. Individual stock investments offer higher potential returns but expose investors to the specific risks associated with each company’s performance. A poorly performing individual stock can significantly impact the overall portfolio return.

Advantages and Disadvantages of Each Approach

- Index Funds/ETFs:

- Advantages: Diversification, low cost, ease of investing.

- Disadvantages: Limited upside potential, exposure to overall market risk.

- Individual Stocks:

- Advantages: Potential for higher returns, active management opportunities.

- Disadvantages: Higher risk, requires more research and analysis.

Examples of Diversification Techniques

Diversification within a Dow-focused portfolio can involve spreading investments across different sectors represented in the index. For example, an investor might allocate funds to technology, finance, consumer goods, and healthcare companies to reduce the impact of any single sector’s underperformance. Combining Dow investments with investments in other asset classes, such as bonds or real estate, further enhances portfolio diversification.

Essential FAQs

What is the difference between the Dow and the S&P 500?

The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 large, publicly owned companies, while the S&P 500 is a market-capitalization-weighted index of 500 large-cap companies. The S&P 500 is generally considered a broader representation of the US stock market.

How often is the Dow calculated?

The Dow is calculated continuously throughout the trading day.

Where can I find real-time Dow data?

Real-time Dow data is available from numerous financial news websites and brokerage platforms.

Is investing in the Dow inherently risky?

Like any stock market investment, investing in the Dow carries risk. While it’s considered relatively stable compared to individual stocks, market fluctuations can still lead to losses.