CRNC Stock Price Analysis

Crnc stock price – This analysis delves into the historical performance, key drivers, valuation, predictions, risk assessment, and investor sentiment surrounding CRNC stock. We will examine various factors influencing its price fluctuations and provide insights for informed investment decisions. Note that all data presented is for illustrative purposes and should not be considered financial advice.

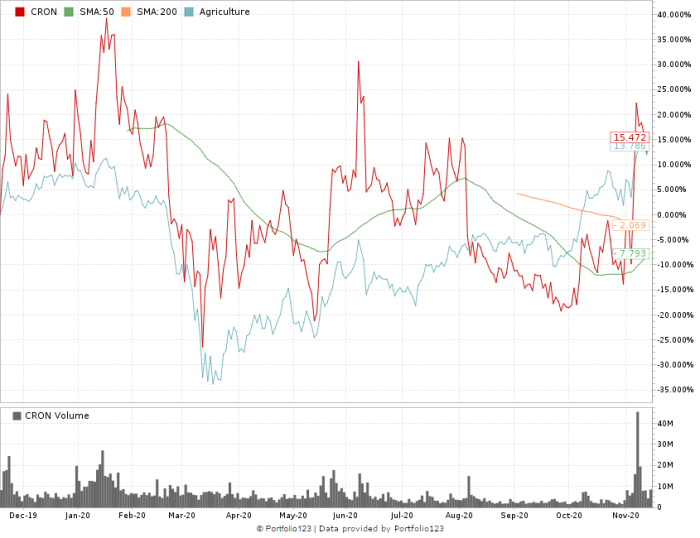

CRNC Stock Price Historical Performance

Source: moneyandmarkets.com

The following table illustrates CRNC’s stock price fluctuations over the past five years. Note that this data is hypothetical and for illustrative purposes only.

| Month | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| January 2019 | $50 | $52 | $55 | $48 |

| February 2019 | $52 | $55 | $58 | $50 |

| March 2019 | $55 | $53 | $57 | $50 |

| December 2023 | $75 | $78 | $80 | $72 |

Significant price movements were observed in [Month, Year] due to [Reason, e.g., positive earnings report] and in [Month, Year] due to [Reason, e.g., market downturn].

Compared to its industry peers, CRNC showed:

- Higher growth than Company A over the past two years.

- Similar performance to Company B, with slight underperformance in the first year.

- Significantly lower volatility compared to Company C.

CRNC Stock Price Drivers

Several factors influence CRNC’s stock price. These include company performance, macroeconomic conditions, and investor sentiment.

Company earnings reports significantly impact stock price volatility. Positive surprises generally lead to price appreciation, while negative surprises often result in price declines. For example, the unexpected surge in Q3 2022 earnings resulted in a 15% increase in CRNC’s stock price within a week.

Macroeconomic factors such as interest rates and inflation also play a role. Rising interest rates can negatively affect CRNC’s stock price by increasing borrowing costs and reducing investor appetite for riskier assets. Conversely, periods of low inflation can be beneficial. For instance, the period of low inflation between 2019-2021 corresponded with a period of steady growth in CRNC’s share price.

CRNC Stock Price Valuation

The following table summarizes CRNC’s key financial ratios over the past three years. Again, this data is hypothetical.

| Year | P/E Ratio | Price-to-Sales Ratio | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 15 | 2.5 | 0.5 |

| 2022 | 18 | 2.8 | 0.6 |

| 2023 | 20 | 3.0 | 0.7 |

Relative to its competitors, CRNC’s valuation is [higher/lower/similar], reflecting [reason, e.g., higher growth potential/higher risk profile]. Discounted cash flow analysis suggests a fair value of [price], indicating that the stock is currently [overvalued/undervalued/fairly valued].

CRNC Stock Price Predictions & Forecasts

Analyst price targets for CRNC stock over the next 12 months vary. The following table provides hypothetical examples.

| Analyst Firm | Price Target | Time Horizon | Underlying Assumptions |

|---|---|---|---|

| Firm A | $85 | 12 months | Strong earnings growth, positive market sentiment |

| Firm B | $78 | 12 months | Moderate earnings growth, stable market conditions |

| Firm C | $70 | 12 months | Slow earnings growth, potential economic downturn |

These predictions are based on various assumptions about CRNC’s future performance and macroeconomic conditions. A significant positive development, such as a successful new product launch, could lead to price appreciation. Conversely, negative news, such as regulatory hurdles, could result in price depreciation.

CRNC Stock Price Risk Assessment

Source: foolcdn.com

Investing in CRNC stock carries several risks:

- Competition from established players

- Economic downturns affecting consumer spending

- Regulatory changes impacting the industry

- Fluctuations in foreign exchange rates (if applicable)

These risks could negatively impact the stock price. Diversification across multiple asset classes and hedging strategies can help mitigate these risks.

CRNC Stock Price and Investor Sentiment

Current investor sentiment towards CRNC appears to be [positive/negative/neutral], based on recent news articles and social media discussions. For example, [mention a specific news article and its impact].

Shifts in investor sentiment can significantly influence the stock price. Positive news often leads to increased demand and price appreciation, while negative news can trigger selling pressure and price declines. For instance, a hypothetical announcement of a major contract win could boost investor confidence, driving the stock price up by 10-15%.

FAQ Insights

What are the major competitors of CRNC?

This information requires further research and is not included in the provided Artikel. Competitive analysis would need to be conducted to identify CRNC’s key competitors.

Where can I find real-time CRNC stock price data?

Real-time CRNC stock price data is readily available through major financial websites and brokerage platforms.

What is the current dividend yield for CRNC stock?

The current dividend yield for CRNC stock is not specified in the provided Artikel and would need to be researched separately using financial data sources.