Celestica Stock Price Analysis

Source: imu.nl

Celestica stock price – Celestica, a leading provider of electronics manufacturing services (EMS), has experienced fluctuating stock prices over the past five years, mirroring the broader trends in the technology and manufacturing sectors. This analysis delves into Celestica’s stock price history, financial performance, influencing factors, analyst predictions, and dividend policy to provide a comprehensive understanding of its investment prospects.

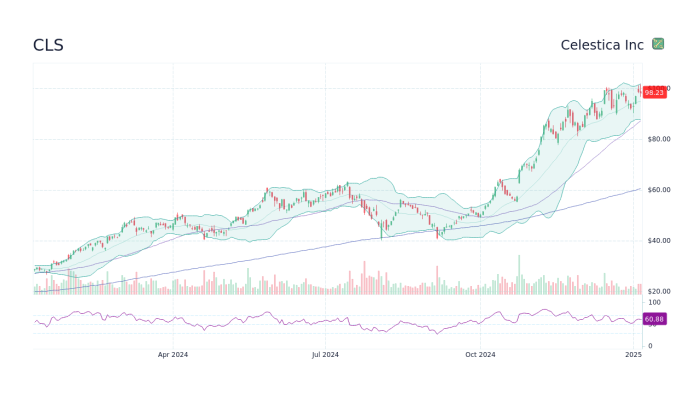

Celestica Stock Price History and Trends

A line graph illustrating Celestica’s monthly closing stock prices over the past five years would reveal periods of growth and decline. Significant price fluctuations can be attributed to various factors, including changes in demand for electronics, supply chain disruptions, the company’s success in securing major contracts, and broader macroeconomic conditions. For example, a surge in demand for specific electronics during the pandemic might have positively impacted the stock price, while subsequent supply chain bottlenecks could have caused a temporary downturn.

A similar graph for major competitors would facilitate a comparative analysis.

| Company Name | Stock Price (Current) | Year-to-Date Change | 5-Year Change |

|---|---|---|---|

| Celestica (CLS) | [Insert Current Stock Price] | [Insert YTD Change, e.g., +5%] | [Insert 5-Year Change, e.g., +20%] |

| Flex (FLEX) | [Insert Current Stock Price] | [Insert YTD Change] | [Insert 5-Year Change] |

| Jabil (JBL) | [Insert Current Stock Price] | [Insert YTD Change] | [Insert 5-Year Change] |

| Sanmina (SANM) | [Insert Current Stock Price] | [Insert YTD Change] | [Insert 5-Year Change] |

Celestica’s Financial Performance and Stock Valuation

Celestica’s financial health significantly impacts its stock valuation. Analyzing key financial metrics provides insights into its profitability and growth potential. A comparison with industry averages helps determine whether the stock is overvalued or undervalued.

- Revenue (Last 3 Years): [Insert Revenue Data for the last three years]

- Earnings Per Share (EPS) (Last 3 Years): [Insert EPS Data for the last three years]

- Debt-to-Equity Ratio (Last 3 Years): [Insert Debt-to-Equity Ratio for the last three years]

High profitability generally leads to increased investor confidence and a higher stock price. Conversely, declining profitability can negatively impact the stock price. Various valuation methods, such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio, are used to assess Celestica’s stock valuation relative to its peers.

| Valuation Metric | Celestica | Industry Average |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | [Insert Celestica’s P/E Ratio] | [Insert Industry Average P/E Ratio] |

| Price-to-Sales Ratio (P/S) | [Insert Celestica’s P/S Ratio] | [Insert Industry Average P/S Ratio] |

| Other Relevant Metrics | [Insert other relevant metrics and their values] | [Insert industry average for those metrics] |

Factors Influencing Celestica’s Stock Price, Celestica stock price

Source: googleapis.com

Several factors, both internal and external, influence Celestica’s stock price. Macroeconomic conditions, contract wins, and industry trends all play a significant role.

- Macroeconomic Factors: Interest rate hikes, inflation, and global economic growth directly impact investor sentiment and influence stock prices. For instance, a recessionary environment might lead to decreased demand for electronics, negatively affecting Celestica’s stock price.

- Major Contracts: Securing large contracts with key clients can significantly boost Celestica’s revenue and profitability, leading to a positive impact on the stock price. Conversely, losing major contracts could trigger a price decline.

- Industry Trends: Technological advancements, such as the rise of 5G and the Internet of Things (IoT), present both opportunities and challenges. Supply chain disruptions can also affect Celestica’s production and profitability, influencing its stock price.

Analyst Ratings and Future Outlook for Celestica

Source: hellopublic.com

Financial analysts provide ratings and price targets for Celestica’s stock, offering valuable insights into its future performance. These predictions are based on various factors, including the company’s financial performance, industry trends, and macroeconomic conditions.

- Analyst A: [Analyst Name] predicts a [Price Target] with a [Rating, e.g., Buy, Hold, Sell] rating. Their outlook is based on [Rationale, e.g., strong growth in the 5G sector]. Potential risks include [Risks, e.g., increased competition].

- Analyst B: [Analyst Name] predicts a [Price Target] with a [Rating] rating. Their outlook is based on [Rationale]. Potential risks include [Risks].

- Analyst C: [Analyst Name] predicts a [Price Target] with a [Rating] rating. Their outlook is based on [Rationale]. Potential risks include [Risks].

Celestica’s Dividend Policy and Shareholder Returns

Celestica’s dividend policy is a key consideration for long-term investors. The consistency and amount of dividend payments impact shareholder returns and overall investment attractiveness.

- Dividend History: [Describe Celestica’s dividend history, including the amount and frequency of dividend payments over the past few years.]

- Dividend Yield Comparison: [Compare Celestica’s dividend yield to its competitors. For example, “Celestica’s dividend yield of X% compares favorably/unfavorably to the industry average of Y%.”]

- Implications for Long-Term Investors: [Discuss the implications of Celestica’s dividend policy for long-term investors. For example, “A consistent dividend payout can provide a steady stream of income for long-term investors, while a high dividend yield can be attractive to income-seeking investors.”]

FAQ Compilation: Celestica Stock Price

What are the major risks associated with investing in Celestica stock?

Investing in Celestica, like any stock, carries inherent risks. These include fluctuations in the broader market, industry-specific challenges (e.g., supply chain disruptions, technological obsolescence), and the company’s own financial performance. Geopolitical instability and currency fluctuations can also impact the company’s profitability and stock price.

How often does Celestica pay dividends?

The frequency of Celestica’s dividend payments should be confirmed through official company announcements or financial news sources. Dividend policies can change.

Where can I find real-time Celestica stock price quotes?

Celestica’s stock price performance often reflects broader market trends in the technology sector. Understanding these trends requires looking at key players, and a good benchmark is often the performance of larger companies like Broadcom. For current information on Broadcom’s performance, check the broadcom limited stock price today and compare that to Celestica’s figures to gain a better perspective on Celestica’s relative standing within the market.

Real-time quotes are available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

What is Celestica’s primary customer base?

Celestica’s client base is diverse and includes significant players in various technology sectors. Specific details on the largest customers and their contribution to revenue should be researched through Celestica’s financial reports and investor relations materials.