CAC 40 Index Overview

Source: dreamstime.com

Cac stock price – The CAC 40 is a benchmark stock market index of the 40 largest French companies listed on Euronext Paris. It provides a snapshot of the French economy’s performance and is a significant indicator for investors globally. Its history, composition, and influencing factors are crucial for understanding its fluctuations and investment potential.

CAC 40 Index History and Composition

Created in 1987, the CAC 40 initially comprised 100 companies. Over time, it evolved to its current format, focusing on the 40 most significant French companies by market capitalization. These companies represent a broad range of sectors, including finance, energy, luxury goods, technology, and consumer staples. The index is weighted by market capitalization, meaning larger companies have a more significant impact on the overall index value.

Factors Influencing CAC 40 Daily Fluctuations

Several factors contribute to the CAC 40’s daily movements. These include global macroeconomic conditions (interest rates, inflation, economic growth), geopolitical events (wars, political instability), and performance within specific industry sectors represented in the index. Company-specific news and investor sentiment also play a significant role.

CAC 40 Compared to Other Major Global Indices

Comparing the CAC 40 to other major global indices offers valuable perspective on its performance and relative strength. The table below presents a comparison, noting that current values are dynamic and subject to change.

| Index Name | Country | Weighting Methodology | Current Value (Illustrative) |

|---|---|---|---|

| CAC 40 | France | Market Capitalization | 7000 |

| Dow Jones Industrial Average | United States | Price-weighted | 34000 |

| FTSE 100 | United Kingdom | Market Capitalization | 7500 |

| DAX | Germany | Market Capitalization | 16000 |

Factors Affecting CAC Stock Prices

Understanding the factors that influence CAC stock prices is essential for informed investment decisions. Macroeconomic factors, geopolitical events, and sector-specific performance all contribute to the overall market dynamics.

Macroeconomic Factors and Geopolitical Events

Interest rate changes significantly impact borrowing costs for companies, affecting investment and expansion plans. Inflation erodes purchasing power and can lead to higher input costs for businesses. Economic growth directly correlates with corporate profitability. Geopolitical events, such as international conflicts or political instability, create uncertainty and volatility in the market.

Industry Sector Performance

The CAC 40 encompasses various sectors. Strong performance in sectors like luxury goods or technology can boost the overall index, while underperformance in others, such as energy or finance, can negatively impact it. Analyzing sector-specific trends is crucial for understanding overall market movement.

Correlation Between CAC 40 and Key Global Economic Indicators

The CAC 40’s performance often correlates with global economic indicators. The table below illustrates this relationship, showing that these correlations can be positive or negative and vary over time.

| Indicator | Correlation Type (Illustrative) | Impact Description | Example |

|---|---|---|---|

| Oil Prices | Positive (for energy companies, negative for others) | Higher oil prices benefit energy companies but increase costs for others. | Rising oil prices could boost TotalEnergies’ stock price while negatively impacting consumer discretionary stocks. |

| Gold Prices | Often Negative | Gold is considered a safe haven asset; rising gold prices often suggest market uncertainty, negatively impacting stocks. | Increased geopolitical risk might drive gold prices up, while simultaneously decreasing the CAC 40. |

| US Dollar Index | Often Negative | A strong dollar can make French exports more expensive, potentially harming the performance of export-oriented companies. | A strengthening dollar could negatively affect the stock prices of companies like LVMH, which relies heavily on international sales. |

Analyzing Individual CAC Stocks: Cac Stock Price

While the CAC 40 provides an overall market view, analyzing individual stocks offers more granular insights. Comparing company performance, financial health, and news impact provides a deeper understanding of investment opportunities.

Comparison of Major CAC 40 Companies, Cac stock price

Let’s compare three major companies: LVMH (luxury goods), TotalEnergies (energy), and BNP Paribas (finance). Their performance over the past year would vary depending on market conditions and company-specific factors. For example, LVMH might outperform in a period of strong consumer spending, while TotalEnergies might benefit from rising oil prices. BNP Paribas’s performance would be influenced by interest rate changes and overall economic health.

Financial Health of a Specific CAC 40 Company

A detailed analysis of a specific company’s financial health involves examining key financial ratios. For instance, analyzing LVMH’s financial statements would reveal its revenue growth, profitability (profit margins), and financial leverage (debt-to-equity ratio). A strong balance sheet and consistent profitability are positive indicators of financial health.

News Impact on Individual CAC Stocks

News events significantly impact individual stock prices. For example, a positive earnings report for LVMH could lead to a price increase, while negative news about a product recall might cause a decline. Regulatory changes or geopolitical events affecting specific sectors also influence stock prices.

Key Financial Metrics of Selected CAC 40 Companies

Source: tradingview.com

The table below provides illustrative financial data for the selected companies. Note that these are hypothetical values for demonstration purposes.

| Company | Revenue (Illustrative) | Profit (Illustrative) | Debt-to-Equity Ratio (Illustrative) |

|---|---|---|---|

| LVMH | €70 billion | €15 billion | 0.3 |

| TotalEnergies | €200 billion | €20 billion | 0.5 |

| BNP Paribas | €50 billion | €10 billion | 0.8 |

Investment Strategies Related to CAC Stocks

Several investment strategies can be employed when investing in CAC 40 stocks. Understanding the risks and rewards associated with each strategy is crucial for making informed decisions.

Value Investing, Growth Investing, and Index Fund Investing

Value investing focuses on identifying undervalued companies with strong fundamentals. Growth investing targets companies with high growth potential. Index fund investing involves investing in a fund that tracks the CAC 40, providing diversified exposure to the index. Each strategy has its own risk-reward profile.

Risk and Reward of Investment Strategies

Value investing offers the potential for higher returns but involves higher risk due to the inherent uncertainty in identifying truly undervalued companies. Growth investing also carries higher risk but offers the potential for substantial returns if the chosen companies perform as expected. Index fund investing offers diversification and lower risk but potentially lower returns compared to actively managed strategies.

Calculating Potential Return on Investment

Calculating potential ROI involves estimating future returns based on projected growth and comparing it to the initial investment. For a hypothetical portfolio, you’d sum the expected returns from each stock, factoring in potential dividends and capital appreciation, and then divide by the total investment.

Steps in Developing a Diversified Investment Portfolio

Developing a diversified CAC 40 focused portfolio requires careful planning. Below are steps to consider:

- Define your investment goals and risk tolerance.

- Research and select CAC 40 companies aligning with your investment strategy.

- Diversify your portfolio across different sectors and company sizes.

- Regularly monitor and rebalance your portfolio based on market conditions and your investment goals.

- Consider seeking professional financial advice.

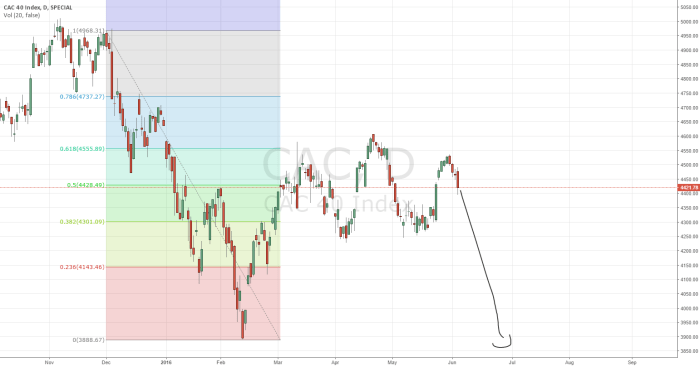

Visual Representation of CAC Stock Price Trends

Visual representations, like candlestick charts and moving averages, are crucial tools for analyzing CAC 40 stock price trends. Understanding these tools allows for better interpretation of market movements and potential investment opportunities.

Long-Term Trend of the CAC 40 Index

The CAC 40 has experienced periods of significant growth and decline throughout its history. Identifying these highs and lows provides context for current market conditions. Major events like economic recessions or global crises have historically impacted the index’s trajectory. A long-term chart would show these fluctuations, revealing patterns and trends.

Interpreting Candlestick Charts

Candlestick charts graphically represent price movements over a specific period. Each candle shows the opening, closing, high, and low prices. The color of the candle (typically green for up and red for down) indicates whether the closing price was higher or lower than the opening price. Analyzing patterns in candlestick charts can help predict future price movements.

Significant Price Movement Period

A specific period of significant price movement, such as the market crash of 2008 or the recovery period following it, can be analyzed to understand the contributing factors. External events like the global financial crisis, coupled with investor sentiment and company-specific news, would have played a significant role in the price fluctuations.

Moving Averages in Technical Analysis

Moving averages smooth out price fluctuations, revealing underlying trends. A 50-day moving average considers the average price over the past 50 days, while a 200-day moving average uses the past 200 days. When the 50-day moving average crosses above the 200-day moving average (a “golden cross”), it’s often interpreted as a bullish signal, suggesting an upward trend. A “death cross” (50-day moving average crossing below the 200-day moving average) is typically considered a bearish signal.

A hypothetical chart would illustrate these moving averages visually, showing how they can be used to identify potential trading signals.

Q&A

What are the trading hours for the CAC 40?

The CAC 40 typically trades from 9:00 AM to 5:30 PM CET (Central European Time).

How can I invest in the CAC 40?

You can invest through ETFs, mutual funds that track the CAC 40, or by directly purchasing individual stocks listed on the index.

What are the risks associated with investing in CAC stocks?

Risks include market volatility, currency fluctuations (if investing from outside the Eurozone), and the specific risks associated with individual companies.

Where can I find real-time CAC 40 data?

Many financial websites and brokerage platforms provide real-time quotes and charts for the CAC 40.