Understanding the Boston Omaha Stock Price Search

The search term “Boston Omaha Stock Price” reveals a user’s interest in the current market valuation of Boston Omaha Corporation’s stock. Variations in phrasing, however, indicate diverse needs and levels of financial sophistication. Understanding these nuances is crucial for providing relevant information and anticipating user intent.

Potential Meanings and Search Scenarios

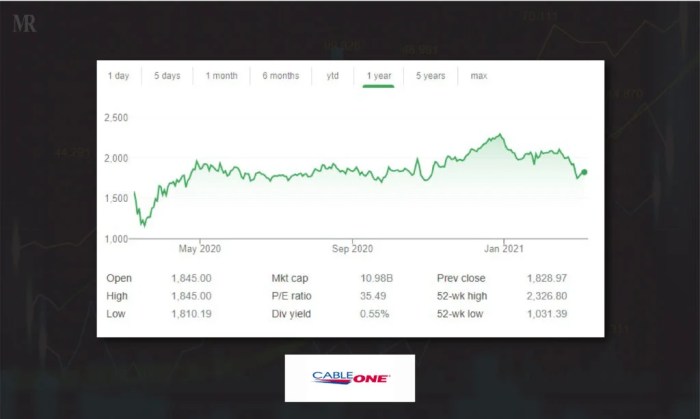

Source: mirrorreview.com

Users searching for “Boston Omaha Stock Price” might be investors actively monitoring their portfolio, potential investors researching investment opportunities, financial analysts conducting market research, or journalists seeking data for a news article. The specificity of their search may also vary, ranging from a simple current price check to a deep dive into historical performance.

Examples of User Queries

Examples of related search queries include: “BOH stock price,” “Boston Omaha Corp stock quote,” “Boston Omaha stock price history,” “BOH stock chart,” “Boston Omaha stock price today,” “real-time Boston Omaha stock price.” These variations highlight the different approaches users take in accessing the desired information.

Interpretations of the Search Term, Boston omaha stock price

| Search Query | User Intent | Information Needed | Level of Sophistication |

|---|---|---|---|

| Boston Omaha Stock Price | Current market value | Real-time price | Beginner |

| BOH Stock Price Today | Current day’s closing price | End-of-day price | Beginner |

| Boston Omaha Stock Price History | Past performance analysis | Historical price data | Intermediate |

| BOH Stock Chart | Visual representation of price movements | Interactive chart with price and volume data | Intermediate/Advanced |

Data Sources for Boston Omaha Stock Price

Reliable sources for real-time and historical Boston Omaha stock price data are essential for accurate analysis. Several reputable financial websites and platforms offer this information, each with its own strengths and weaknesses.

Reliable Data Sources

Major financial websites such as Google Finance, Yahoo Finance, Bloomberg, and Nasdaq provide real-time and historical stock data. Brokerage platforms like Fidelity, Schwab, and TD Ameritrade also offer this information to their clients. Each platform presents data differently, some focusing on concise summaries while others offer more detailed charts and analysis tools.

Data Presentation Differences and Evaluation

- Google Finance/Yahoo Finance: Free, readily accessible, basic charts and data.

- Bloomberg Terminal: Subscription-based, comprehensive data and advanced analytics, expensive.

- Nasdaq: Directly from the exchange, reliable data, may require registration.

- Brokerage Platforms: Data integrated with trading accounts, often includes personalized portfolio views, requires account.

Benefits and Drawbacks of Data Sources

- Benefits: Real-time updates, historical data, charting tools, integrated analysis.

- Drawbacks: Data delays, subscription fees (for some), platform-specific limitations, potential for inaccuracies (though rare from reputable sources).

Factors Influencing Boston Omaha Stock Price

Numerous factors, ranging from broad economic trends to company-specific events, influence Boston Omaha’s stock price. Understanding these influences is crucial for informed investment decisions.

Macroeconomic and Industry Factors

Macroeconomic factors like interest rates, inflation, and overall market sentiment significantly impact stock prices. Industry trends within the insurance and real estate sectors (Boston Omaha’s primary businesses) also play a crucial role. For example, rising interest rates can affect the profitability of real estate investments, while changes in insurance regulations can impact the insurance sector’s performance.

Company-Specific News and Investor Sentiment

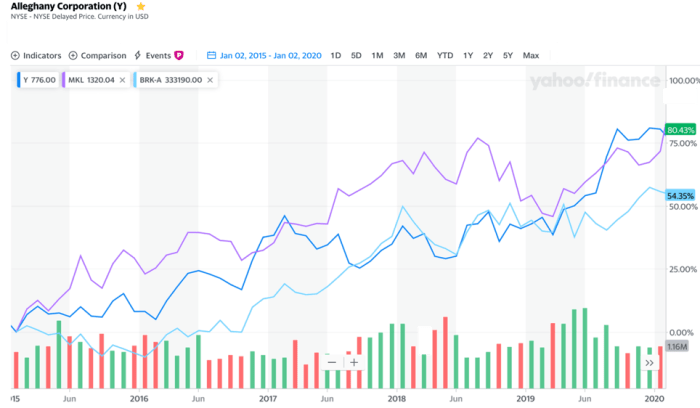

Source: businessinsider.com

Company-specific news, such as earnings reports, new acquisitions, or strategic partnerships, can cause significant price fluctuations. Investor sentiment, driven by news, market conditions, and analyst opinions, also plays a major role. Positive news and strong investor confidence typically lead to price increases, while negative news or uncertainty can trigger declines.

Impact of Key Factors

| Factor | Potential Impact | Example |

|---|---|---|

| Interest Rate Hikes | Negative impact on real estate investments, potentially lowering stock price. | Higher borrowing costs reduce profitability of real estate projects. |

| Strong Earnings Report | Positive impact, driving stock price upward. | Exceeding analysts’ expectations boosts investor confidence. |

| Market Correction | Negative impact, potentially causing a price drop regardless of company performance. | Broad market downturn affecting all stocks, including BOH. |

| New Acquisition | Potentially positive or negative depending on the deal’s success. | Successful integration of a new company boosts revenue; unsuccessful integration lowers profits. |

Analyzing Historical Stock Performance

Analyzing Boston Omaha’s historical stock price data helps identify trends, patterns, and potential future performance. Several methods can be used to gain valuable insights.

Methods for Analyzing Historical Data

Analyzing historical data involves studying price charts to identify trends (uptrends, downtrends, sideways movements), patterns (head and shoulders, double tops/bottoms), and support/resistance levels. Calculating key performance indicators (KPIs) like the average annual return, volatility (standard deviation of returns), and Sharpe ratio provides a quantitative assessment of past performance.

Calculating Key Performance Indicators (KPIs)

Calculating KPIs requires historical price data. The average annual return measures the average yearly growth of the investment. Volatility, calculated as the standard deviation of returns, quantifies the risk associated with the investment. The Sharpe ratio measures risk-adjusted return, comparing the excess return over a risk-free rate to the investment’s volatility.

Visual Representation of a Stock Price Chart

A typical stock price chart displays the price over time. The horizontal axis represents time (daily, weekly, monthly), and the vertical axis represents the stock price. The chart line shows price fluctuations. Volume data (number of shares traded) is often displayed alongside the price, showing trading activity. Support levels represent price points where the price has historically found buying pressure, while resistance levels represent price points where selling pressure has historically been strong.

These levels are not guaranteed, however, and are merely indicative of past trends.

Predicting Future Stock Price Movement (with caveats)

Predicting future stock price movements is inherently challenging due to the complexity of market dynamics. While accurate prediction is impossible, fundamental and technical analysis can offer insights into potential future performance. These methods, however, should be used cautiously, recognizing their limitations.

Limitations of Prediction

Source: seekingalpha.com

Stock prices are influenced by numerous unpredictable factors, making precise predictions nearly impossible. Unexpected news events, shifts in investor sentiment, and broader economic changes can significantly impact stock prices, rendering even sophisticated models inaccurate. Therefore, any prediction should be considered highly speculative.

Fundamental vs. Technical Analysis

Fundamental analysis focuses on evaluating the intrinsic value of a company based on its financial health, competitive position, and future prospects. Technical analysis, on the other hand, uses price charts and technical indicators to identify trends and patterns, aiming to predict future price movements based on past performance. Both approaches have their limitations and strengths, and a combination of both can provide a more holistic view.

Hypothetical Scenario

Imagine Boston Omaha announces unexpectedly strong earnings. Fundamental analysts would likely revise their valuation upwards, anticipating higher future profits. Technical analysts, observing a price surge and increased trading volume, might identify a bullish breakout pattern, suggesting further price appreciation. Conversely, news of a major regulatory setback in the insurance industry could trigger a negative reaction, leading to downward price pressure based on both fundamental and technical analysis.

However, this is merely a hypothetical example, and actual market reactions can be far more complex and nuanced.

FAQ Overview: Boston Omaha Stock Price

What are the potential risks associated with investing in Boston Omaha stock?

Investing in any stock carries inherent risk, including the potential for loss. Factors like market volatility, company performance, and economic downturns can all negatively impact stock prices. Thorough due diligence and diversification are crucial risk management strategies.

Where can I find Boston Omaha’s financial statements?

Boston Omaha’s financial statements, including annual reports and quarterly filings, are typically available on the company’s investor relations website and through the Securities and Exchange Commission (SEC) EDGAR database.

How frequently is Boston Omaha’s stock price updated?

Real-time stock prices for Boston Omaha are typically updated throughout the trading day, reflecting current market activity. The frequency of updates varies depending on the data provider.

What is the difference between fundamental and technical analysis in this context?

Fundamental analysis focuses on evaluating Boston Omaha’s intrinsic value based on its financial health, business model, and industry position. Technical analysis, on the other hand, uses historical price and volume data to identify patterns and predict future price movements.