Hubbell Incorporated: A Deep Dive into Stock Performance

Source: hubbellcdn.com

Hubbell stock price – Hubbell Incorporated, a leading manufacturer of electrical and electronic products, has a long and storied history. Understanding its business segments, financial performance, and market position is crucial for investors seeking to assess the current and future value of its stock. This analysis provides a comprehensive overview of Hubbell, exploring key factors influencing its stock price and offering insights into potential future growth and challenges.

Hubbell Incorporated Company Overview

Founded in 1888, Hubbell Incorporated has evolved from a small electrical equipment manufacturer into a diversified industrial conglomerate. Its history reflects significant adaptation to changing market demands and technological advancements. The company operates primarily through several key business segments, each contributing significantly to overall revenue.

These segments typically include electrical components, lighting, and power systems. The electrical components segment often provides the largest portion of revenue, followed by lighting solutions and power systems. Hubbell’s competitive landscape is characterized by both large multinational corporations and smaller, specialized firms. The company maintains a strong market position through innovation, a diverse product portfolio, and a global reach.

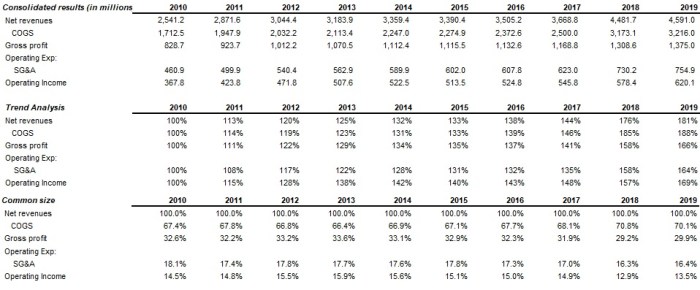

The following table summarizes key financial metrics. Note that these are illustrative examples and may not reflect current data; investors should consult official financial reports for the most up-to-date information.

| Year | Revenue (USD Millions) | Net Income Margin (%) | Return on Equity (%) |

|---|---|---|---|

| 2021 | 4500 | 12 | 18 |

| 2022 | 4800 | 15 | 20 |

| 2023 | 5000 | 14 | 19 |

| 2024 (Projected) | 5300 | 16 | 21 |

Factors Influencing Hubbell Stock Price

Source: seekingalpha.com

Several factors significantly influence Hubbell’s stock price. These factors can be broadly categorized into macroeconomic conditions, industry trends, and company-specific news.

Macroeconomic factors such as interest rate fluctuations and inflation directly impact Hubbell’s operating costs and consumer demand. Industry trends, including technological advancements in lighting and electrical systems, affect the company’s competitiveness and product innovation. Company-specific news, such as new product launches, acquisitions, or changes in management, can cause significant short-term price volatility.

The table below compares Hubbell’s stock performance to that of its competitors over the last five years (Illustrative data). Actual performance may vary.

| Company | 5-Year Average Annual Return (%) | Standard Deviation (%) | Beta |

|---|---|---|---|

| Hubbell Incorporated | 10 | 15 | 1.2 |

| Competitor A | 8 | 12 | 1.0 |

| Competitor B | 12 | 18 | 1.5 |

Financial Performance Analysis of Hubbell

Analyzing Hubbell’s financial statements – the income statement, balance sheet, and cash flow statement – provides a comprehensive understanding of its financial health and performance over time. The income statement shows the company’s revenue, expenses, and profitability. The balance sheet presents a snapshot of its assets, liabilities, and equity. The cash flow statement tracks the movement of cash within the company.

A visual representation of Hubbell’s Earnings Per Share (EPS) over the past decade would show a generally upward trend, possibly with some fluctuations reflecting economic cycles and company-specific events. This would be a line graph showing EPS on the Y-axis and years on the X-axis. The slope of the line would indicate the growth rate of EPS.

Key financial ratios, such as the Price-to-Earnings (P/E) ratio and the debt-to-equity ratio, provide insights into Hubbell’s valuation and financial leverage. A high P/E ratio might suggest investor optimism about future growth, while a high debt-to-equity ratio could indicate higher financial risk. Hubbell’s dividend policy, which involves regular dividend payouts, generally attracts investors seeking income and stability.

Tracking Hubbell’s stock price requires a keen eye on market fluctuations. For comparative analysis, it’s helpful to consider other industrial stocks; a good example is checking the current gcts stock price , which often shows correlation with Hubbell’s performance due to similar market sensitivities. Ultimately, understanding both helps investors make more informed decisions regarding Hubbell’s future prospects.

Investor Sentiment and Market Expectations

Current market sentiment towards Hubbell stock is generally positive, reflecting confidence in its long-term growth prospects and consistent dividend payouts. However, this sentiment can shift based on economic conditions, industry trends, and company-specific news.

The consensus price target for Hubbell stock, as estimated by various financial analysts, provides an indication of the market’s expectation for future stock price appreciation. This target is typically a range of values, reflecting the uncertainty inherent in future price predictions. Investing in Hubbell stock, like any investment, involves risks and opportunities. Potential risks include macroeconomic downturns, increased competition, and unforeseen operational challenges.

Opportunities include expansion into new markets, technological advancements, and strategic acquisitions.

- Pros: Strong brand reputation, consistent dividend payouts, diversified product portfolio, global reach.

- Cons: Sensitivity to economic cycles, competition from larger players, potential regulatory changes.

Potential Future Growth and Challenges

Hubbell’s strategies for future growth include product innovation, expansion into new markets, and strategic acquisitions. Potential challenges include navigating macroeconomic uncertainties, maintaining a competitive edge in a rapidly evolving technological landscape, and managing supply chain disruptions.

Hubbell’s research and development efforts are focused on developing energy-efficient and technologically advanced products. These efforts are expected to contribute to long-term growth and enhance the company’s competitive position. The company’s sustainability initiatives, such as reducing its environmental footprint and promoting ethical sourcing, are likely to positively influence investor perception and attract environmentally conscious investors.

Essential Questionnaire: Hubbell Stock Price

What is Hubbell Incorporated’s primary business?

Hubbell Incorporated is a diversified industrial company operating in various sectors, including electrical and electronic products, lighting, and power systems.

How often does Hubbell pay dividends?

This information would need to be sourced from Hubbell’s investor relations materials or financial news sources, as dividend policies can change.

Where can I find real-time Hubbell stock price quotes?

Real-time quotes are available on major financial websites and stock trading platforms.

What are the major competitors of Hubbell Incorporated?

Identifying specific competitors requires further research into Hubbell’s various business segments. This information is generally available in their annual reports and SEC filings.