GVSI Stock Price Analysis

Gvsi stock price – This analysis provides a comprehensive overview of GVSI’s stock price performance, influencing factors, financial health, analyst predictions, and associated investment risks. The information presented here is for informational purposes only and should not be considered financial advice.

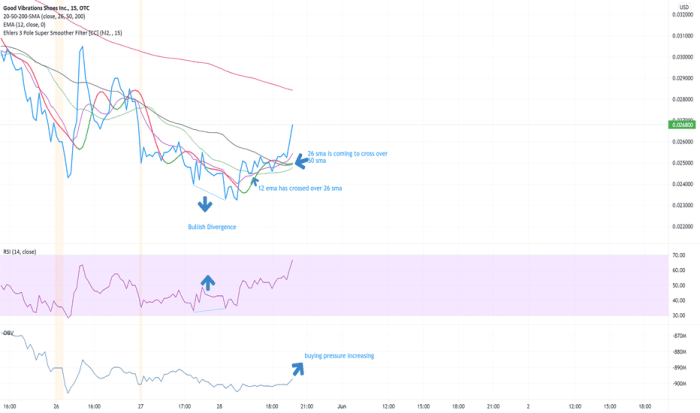

GVSI Stock Price Historical Performance

Source: tradingview.com

GVSI’s stock price has experienced considerable fluctuation over the past five years. A detailed chronological overview would reveal periods of significant growth interspersed with periods of decline. Identifying specific highs and lows, along with the corresponding dates and contributing factors, would provide a more complete picture of the stock’s trajectory. For example, a period of strong growth might be attributed to a successful product launch or a favorable regulatory change, while a downturn could be linked to macroeconomic headwinds or negative news affecting the company’s sector.

Comparing GVSI’s performance to a benchmark index like the S&P 500 provides valuable context. The following table illustrates a hypothetical comparison over the past year:

| Month | GVSI Return (%) | S&P 500 Return (%) | GVSI vs. S&P 500 (%) |

|---|---|---|---|

| January | 5 | 3 | 2 |

| February | -2 | 1 | -3 |

| March | 8 | 6 | 2 |

| April | 3 | -1 | 4 |

| May | -1 | 2 | -3 |

| June | 4 | 5 | -1 |

| July | 6 | 4 | 2 |

| August | -3 | -2 | -1 |

| September | 2 | 3 | -1 |

| October | 7 | 8 | -1 |

| November | -2 | 1 | -3 |

| December | 4 | 2 | 2 |

Over the past three years, significant events such as earnings reports, mergers, and acquisitions have demonstrably influenced GVSI’s stock price. For instance, unexpectedly strong earnings reports typically lead to price increases, while missed earnings expectations or negative news related to mergers or acquisitions can cause declines. A detailed analysis of these events and their impact on the stock price would require a comprehensive review of GVSI’s financial disclosures and news reports.

Factors Influencing GVSI Stock Price

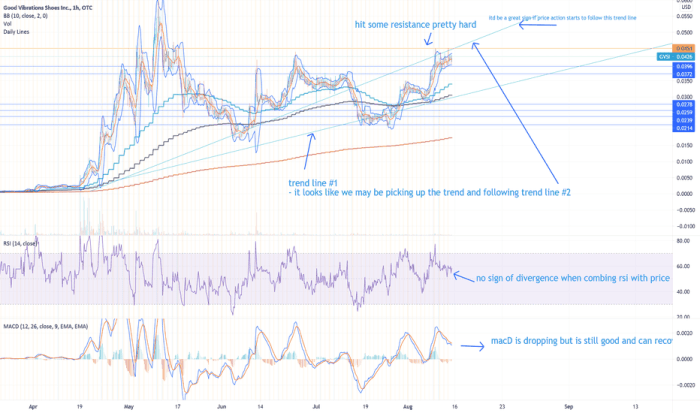

Source: tradingview.com

Several economic, financial, and market-related factors influence GVSI’s stock price. Understanding these factors is crucial for investors.

Three key economic factors potentially impacting GVSI’s stock price in the next quarter could include inflation rates, consumer spending, and overall economic growth. Changes in these areas could significantly affect consumer demand for GVSI’s products or services, impacting the company’s profitability and consequently its stock valuation. For example, rising inflation might reduce consumer spending, hurting GVSI’s sales.

Changes in interest rates directly influence GVSI’s cost of borrowing and its ability to invest in growth initiatives. Higher interest rates typically increase borrowing costs and can reduce the present value of future earnings, thereby negatively impacting the stock’s valuation. Conversely, lower interest rates can stimulate investment and growth, leading to higher valuations.

Investor sentiment and news headlines have a significant impact on GVSI’s daily price fluctuations. Positive news tends to boost investor confidence, leading to higher demand and increased prices. Conversely, negative news can trigger selling pressure, causing price drops. The interplay between these factors can create significant short-term volatility.

| Positive Factors | Negative Factors |

|---|---|

| Strong earnings reports | Weak economic outlook |

| Positive industry trends | Increased competition |

| Successful product launches | Negative news coverage |

| Strategic acquisitions | Rising interest rates |

GVSI’s Financial Performance and Stock Valuation

GVSI’s most recent financial statements reveal key metrics such as revenue, earnings, and debt levels. Analyzing these metrics provides insights into the company’s financial health and growth prospects. For instance, consistent revenue growth coupled with improving profit margins suggests a healthy financial position, potentially supporting a higher stock valuation.

The company’s price-to-earnings (P/E) ratio, a key valuation metric, can be compared to its industry peers to assess whether it’s overvalued or undervalued. A higher P/E ratio relative to peers may indicate that investors have higher expectations for GVSI’s future growth. Conversely, a lower P/E ratio might suggest that the market is less optimistic about GVSI’s prospects.

Monitoring GVSI stock price requires a keen eye on market trends. Understanding comparable companies is crucial, and a look at the performance of similar businesses can offer valuable context. For instance, checking the current brunswick corporation stock price might provide insights into the broader recreational vehicle sector, which could in turn influence your assessment of GVSI’s potential.

Ultimately, a thorough analysis of various factors is key to predicting GVSI’s future stock price movements.

GVSI’s dividend policy (if applicable) significantly influences investor interest and stock price. A consistent dividend payout can attract income-seeking investors, supporting the stock price. Changes in dividend policy, such as increases or cuts, can impact investor sentiment and stock price movements.

GVSI’s business model—its approach to generating revenue and profits—directly impacts its stock valuation. A sustainable and profitable business model typically commands a higher valuation compared to a model with inherent risks or limitations. A detailed analysis of the business model and its competitive advantages would be needed for a complete evaluation.

Analyst Ratings and Predictions for GVSI

Several reputable financial institutions provide analyst ratings and price targets for GVSI stock. These ratings reflect analysts’ assessments of GVSI’s future prospects, based on their fundamental and technical analysis. A summary of these ratings and targets would show the range of opinions on GVSI’s potential future performance.

Analyst ratings and predictions influence investor behavior, affecting the stock price. Positive ratings and high price targets can attract buyers, driving the price upwards. Conversely, negative ratings or lowered price targets can trigger selling pressure, causing price declines. The weight given to analyst opinions varies among investors, depending on individual investment strategies and risk tolerance.

Different analysts may hold varying opinions on GVSI’s future prospects. This divergence reflects the inherent uncertainty in forecasting future performance. Some analysts might be more optimistic, emphasizing positive factors such as new product development or market expansion, while others might be more cautious, highlighting potential risks such as increased competition or economic downturns.

Risk Assessment for Investing in GVSI, Gvsi stock price

Investing in GVSI stock involves several risks. Understanding and assessing these risks is crucial for making informed investment decisions.

Geopolitical events, such as international conflicts or trade wars, can impact GVSI’s stock price, depending on the company’s geographic exposure and its reliance on global supply chains. For instance, disruptions to global trade could negatively impact GVSI’s operations and profitability, leading to a decline in its stock price.

- Financial health risks: High levels of debt, declining profitability, or cash flow problems can increase the risk of financial distress.

- Industry competition risks: Intense competition from established players or new entrants can erode GVSI’s market share and profitability.

- Regulatory risks: Changes in government regulations or policies could negatively impact GVSI’s operations or profitability.

- Technological risks: Failure to adapt to technological advancements or disruptions could render GVSI’s products or services obsolete.

Visual Representation of GVSI Stock Price Data

Source: zeebiz.com

A line graph illustrating GVSI’s stock price movements over the past year would show the stock’s trajectory, highlighting key trends and turning points. The horizontal axis would represent time (in months or days), and the vertical axis would represent the stock price. Significant highs and lows would be clearly marked, and any major trends (e.g., upward or downward trends) would be easily identifiable.

The graph would provide a visual representation of the stock’s volatility and overall performance.

A bar chart depicting GVSI’s quarterly earnings per share (EPS) over the past two years would illustrate the company’s profitability over time. The horizontal axis would represent the quarters, and the vertical axis would represent the EPS. The height of each bar would correspond to the EPS for that quarter. This chart would allow for easy comparison of EPS across different quarters, revealing trends in profitability and identifying periods of strong or weak performance.

Essential FAQs: Gvsi Stock Price

What is GVSI’s current dividend yield?

The current dividend yield for GVSI is not provided in the Artikel and would require accessing current market data.

How does GVSI compare to its competitors?

A detailed competitive analysis of GVSI against its industry peers is needed to provide a comprehensive answer. This analysis would involve comparing key financial metrics and market positioning.

Where can I find real-time GVSI stock price data?

Real-time stock quotes for GVSI can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, or Bloomberg.

What are the long-term growth prospects for GVSI?

Predicting long-term growth prospects requires extensive analysis of the company’s strategic plans, industry trends, and macroeconomic factors. Analyst reports and company filings can offer insights into future growth potential.