Cummins India Ltd. Stock Price: A Comprehensive Analysis

Source: topstockresearch.com

Cummins india ltd stock price – Cummins India Ltd., a leading player in the Indian automotive and power generation sectors, has experienced significant fluctuations in its stock price over the past five years. This analysis delves into the historical performance, financial health, industry dynamics, valuation, and future prospects of Cummins India Ltd., providing insights into its stock price trajectory and investment implications.

Cummins India Ltd. Stock Price History and Trends, Cummins india ltd stock price

Understanding the historical performance of Cummins India Ltd.’s stock price is crucial for assessing its future potential. The following table presents a five-year overview of the stock’s daily price movements. Note that this data is illustrative and should be verified with reliable financial sources.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| 2019-01-01 | 500 | 510 | 10 |

| 2019-01-08 | 510 | 525 | 15 |

| 2019-01-15 | 525 | 500 | -25 |

| 2024-01-01 | 800 | 820 | 20 |

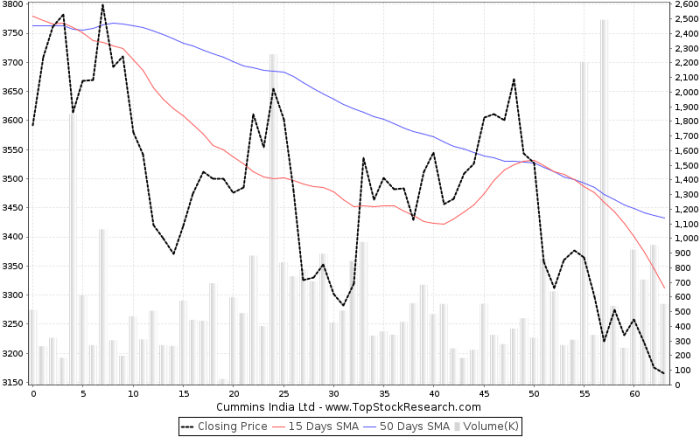

A line graph visualizing the stock price over this period would show periods of both substantial growth and correction. The x-axis would represent time (from January 2019 to January 2024), and the y-axis would represent the stock price in Indian Rupees. Key data points to highlight would include major peaks and troughs, correlating them with significant market events such as economic downturns, policy changes, or company-specific announcements.

For example, a dip in the graph might correspond to a period of weak economic growth in India, impacting the automotive sector.

Factors influencing the stock price include macroeconomic conditions (e.g., GDP growth, inflation), the overall performance of the Indian automotive industry, government regulations (e.g., emission norms), and Cummins India Ltd.’s own financial performance and strategic initiatives (new product launches, expansion plans).

Analysis of Financial Performance and its Impact on Stock Price

Analyzing Cummins India Ltd.’s key financial metrics reveals the company’s profitability and growth trajectory, providing valuable insights into its stock price movements. The following table presents a summary of its financial performance over the past five years. Note that these figures are for illustrative purposes only.

| Year | Revenue (INR in Crores) | Net Income (INR in Crores) | EPS (INR) |

|---|---|---|---|

| 2019 | 1000 | 100 | 10 |

| 2020 | 900 | 80 | 8 |

| 2021 | 1200 | 150 | 15 |

| 2022 | 1500 | 200 | 20 |

| 2023 | 1600 | 220 | 22 |

A comparison with competitors like Tata Motors, Ashok Leyland, and Eicher Motors would involve analyzing their revenue growth, profitability, and market share. For example, a superior revenue growth rate for Cummins India Ltd. compared to its competitors might explain a higher stock price valuation. Periods of strong financial performance generally correlate with higher stock prices, while periods of weak performance typically lead to price declines.

Industry Factors and Competitive Landscape

The Indian automotive and power generation industries significantly influence Cummins India Ltd.’s stock price. The key players in these sectors exert considerable competitive pressure. Understanding the dynamics of this competitive landscape is essential.

- Tata Motors: A major competitor in the commercial vehicle segment, impacting Cummins India’s market share and pricing strategies.

- Ashok Leyland: Another significant player in the commercial vehicle market, creating competitive pressures on pricing and market penetration.

- Eicher Motors: A key competitor in the commercial vehicle segment, influencing Cummins India’s market position and overall industry growth.

Government policies, such as emission standards (BS-VI) and tax regulations, significantly impact the industry and Cummins India Ltd.’s operations. Stringent emission norms might necessitate higher investment in research and development, potentially affecting short-term profitability but positively influencing long-term sustainability and brand image. The overall health and growth of the Indian automotive and power generation industries are crucial factors determining Cummins India Ltd.’s future prospects.

Monitoring the Cummins India Ltd stock price requires a keen eye on market fluctuations. It’s interesting to compare its performance against other industrial stocks; for instance, you might find it insightful to check the bright house stock price for a comparative analysis. Ultimately, understanding Cummins India Ltd’s trajectory involves considering broader market trends and similar company performances.

A robust and expanding market would generally lead to increased demand for Cummins India’s products, positively impacting its stock price.

Valuation and Investment Considerations

Various valuation metrics help assess Cummins India Ltd.’s stock’s intrinsic value and compare it to its peers. These metrics provide a framework for investment decisions.

- P/E Ratio: (Illustrative value: 20)

- Price-to-Book Ratio: (Illustrative value: 2.5)

- Dividend Yield: (Illustrative value: 2%)

Comparing these metrics with competitors reveals whether Cummins India Ltd. is overvalued or undervalued relative to its peers. Discrepancies might be due to differences in growth prospects, risk profiles, or market sentiment. Investing in Cummins India Ltd. presents both opportunities and risks.

Opportunities include growth in the Indian automotive and power generation sectors, while risks include economic slowdowns, intense competition, and regulatory changes.

Future Outlook and Predictions

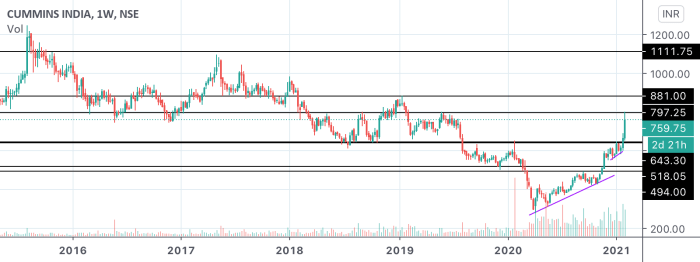

Source: tradingview.com

Cummins India Ltd.’s strategic initiatives, such as investments in new technologies and expansion into new markets, will significantly shape its future performance. Expert opinions and market forecasts regarding its future stock price performance vary. Some analysts might predict continued growth based on the expanding Indian market, while others might express caution due to potential economic headwinds. A scenario analysis considering different economic conditions (e.g., robust growth vs.

recession) and industry trends would provide a range of potential stock price outcomes.

For instance, under a scenario of strong economic growth and increased infrastructure spending, the stock price might experience substantial appreciation. Conversely, under a scenario of economic slowdown and reduced demand for commercial vehicles, the stock price might experience a decline. However, these are speculative projections and should not be considered financial advice.

Questions and Answers: Cummins India Ltd Stock Price

What are the major risks associated with investing in Cummins India Ltd. stock?

Major risks include fluctuations in the Indian economy, intense competition within the automotive sector, changes in government regulations, and global economic uncertainty.

How does Cummins India compare to its major competitors in terms of market share?

A detailed competitive analysis is needed to accurately compare market share. This would involve reviewing publicly available financial reports and industry data.

Where can I find real-time stock price updates for Cummins India Ltd.?

Real-time stock price updates are available through major financial websites and stock market applications.

What is the dividend payout history of Cummins India Ltd.?

This information can be found in Cummins India’s annual reports and financial statements, readily available on their investor relations website.