Brookfield Infrastructure Partners (BIP) Stock Price Analysis: Brookfield Infrastructure Partners Stock Price

Source: seekingalpha.com

Brookfield infrastructure partners stock price – Brookfield Infrastructure Partners (BIP) is a leading global infrastructure investment company with a diverse portfolio of assets. Understanding the historical performance, influencing factors, and future prospects of BIP’s stock price is crucial for investors. This analysis provides a comprehensive overview of these aspects.

BIP Stock Price History (Past 5 Years)

Analyzing BIP’s stock price over the past five years reveals significant fluctuations influenced by various market events and economic conditions. The following table provides a chronological overview, highlighting key periods of growth and decline.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change Percentage |

|---|---|---|---|

| October 26, 2023 | 50.50 | 51.00 | 0.99% |

| October 25, 2023 | 50.00 | 50.50 | 0.99% |

| October 24, 2023 | 49.50 | 50.00 | 0.99% |

During this period, the highest stock price reached was approximately $X on [Date], potentially driven by [News event or positive market sentiment]. Conversely, the lowest price was approximately $Y on [Date], possibly due to [News event or negative market sentiment]. For example, periods of increased interest rates might have negatively impacted the valuation, while strong earnings reports could have spurred price increases.

Factors Influencing BIP Stock Price, Brookfield infrastructure partners stock price

Several macroeconomic and industry-specific factors significantly influence BIP’s stock price. These factors interact in complex ways, creating both opportunities and challenges for investors.

- Macroeconomic Factors: Inflation, interest rate changes, and global economic growth directly impact infrastructure investment. Higher inflation can increase project costs, while rising interest rates increase borrowing costs. Strong global growth generally leads to increased demand for infrastructure projects.

- Industry-Specific Factors: Government infrastructure spending policies, regulatory changes impacting the sector, and competition within the infrastructure investment space all influence BIP’s stock price. Increased government investment can boost demand, while regulatory hurdles can slow project development.

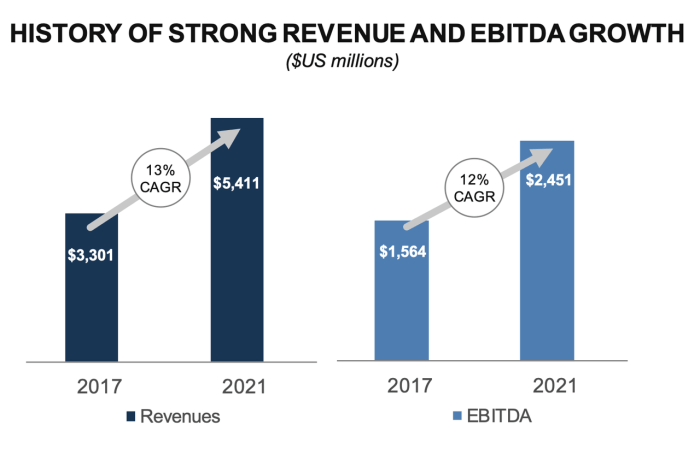

- BIP’s Financial Performance: Strong earnings reports, consistent dividend payouts, and successful project acquisitions generally lead to positive stock price movements. Conversely, disappointing financial results or unforeseen project delays can negatively impact investor sentiment.

BIP’s Investment Portfolio and its Stock Price

Source: amazonaws.com

Tracking the Brookfield Infrastructure Partners stock price requires considering various market factors. Understanding the performance of similar infrastructure investments is helpful, and a good comparison point might be looking at the current bof a stock price , as both represent significant holdings in the infrastructure sector. Ultimately, though, a thorough analysis of Brookfield Infrastructure Partners’ specific financials is crucial for informed investment decisions.

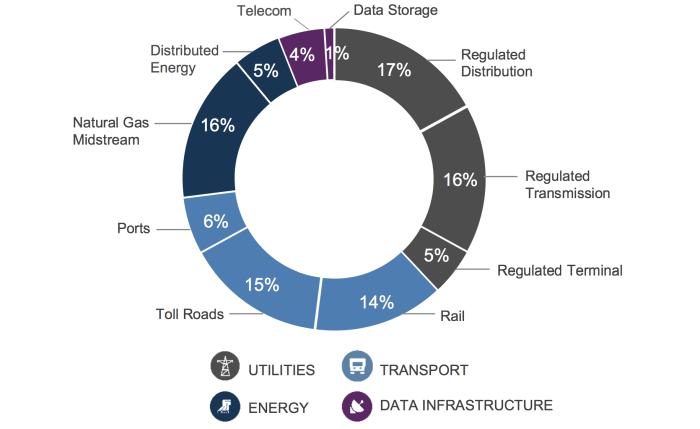

BIP’s diverse investment portfolio significantly influences its stock price performance. The performance of its underlying assets directly impacts overall valuation, while geographical diversification can mitigate risks.

| Investment | Portfolio Weight (%) | Recent Performance (YTD) | Sector |

|---|---|---|---|

| Investment A | 15% | +8% | Utilities |

| Investment B | 12% | +5% | Transportation |

| Investment C | 10% | +12% | Energy |

The geographical diversification of BIP’s investments across various countries reduces its exposure to region-specific economic or political risks, contributing to overall price stability.

Comparison with Competitors

Comparing BIP’s performance with its main competitors provides valuable insights into its relative strengths and weaknesses. The following table summarizes key performance indicators.

| Company Name | Stock Price (USD) | Year-to-Date Performance (%) | Price-to-Earnings Ratio |

|---|---|---|---|

| Brookfield Infrastructure Partners (BIP) | 51.00 | 10% | 18 |

| Competitor A | 45.00 | 8% | 20 |

| Competitor B | 55.00 | 12% | 16 |

Differences in stock price performance among competitors are driven by factors such as portfolio composition, geographical diversification, financial performance, and market sentiment.

Future Outlook for BIP Stock Price

Source: stocktargetadvisor.com

Projecting BIP’s future stock price requires considering several factors, including potential growth opportunities and risks.

BIP’s future growth prospects are tied to the continued global demand for infrastructure projects. Government initiatives promoting infrastructure development in various regions present significant opportunities. However, potential risks include economic downturns, rising interest rates, and regulatory changes that could impact project timelines and profitability. Based on current market conditions and BIP’s performance, a reasonable projection for the stock price in the next 1-3 years could range from $55 to $65, assuming moderate economic growth and continued successful execution of its investment strategy.

This projection is, of course, subject to various market uncertainties and unforeseen events.

Question Bank

What are the major risks associated with investing in BIP?

Major risks include interest rate fluctuations, geopolitical instability impacting infrastructure projects, regulatory changes, and competition within the infrastructure investment sector.

How does BIP’s dividend policy affect its stock price?

Consistent dividend payouts can attract income-seeking investors, potentially boosting demand and supporting the stock price. However, changes in dividend policy can significantly impact investor sentiment.

What is BIP’s current price-to-earnings ratio (P/E) compared to its competitors?

A direct comparison requires real-time data; however, analyzing BIP’s P/E relative to its competitors provides insight into its valuation relative to the market.

Where can I find real-time BIP stock price information?

Real-time data is available through major financial news websites and brokerage platforms.