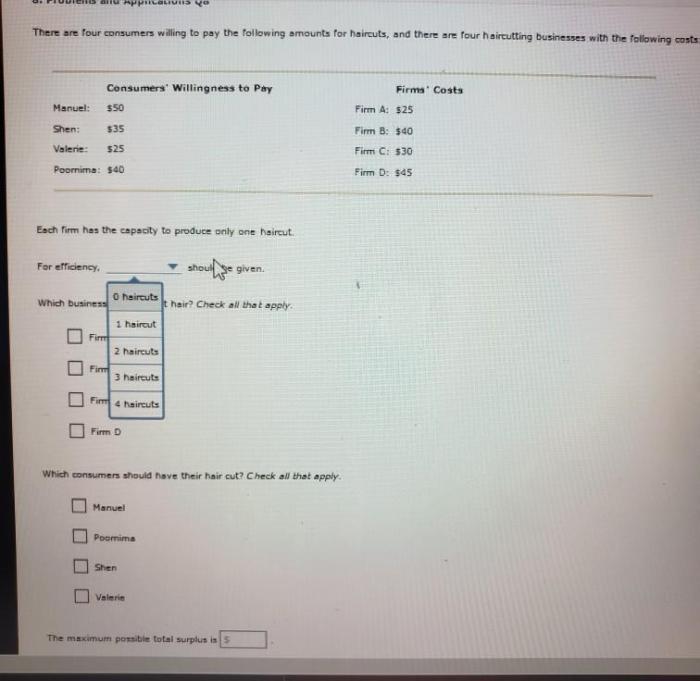

Bid-Ask Spread Dynamics

Bid ask price stock – The bid-ask spread, the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask), is a fundamental concept in understanding market dynamics. Its size reflects several factors and provides valuable insights into a stock’s liquidity and overall market efficiency.

Factors Influencing Bid-Ask Spreads

Several factors influence the bid-ask spread. These include the stock’s volatility, trading volume, order size, market microstructure, and the presence of market makers. Highly volatile stocks tend to have wider spreads due to increased uncertainty, while stocks with high trading volume generally exhibit narrower spreads due to increased liquidity. Large orders can temporarily widen spreads as they require more time and effort to fill.

The efficiency of the market microstructure also plays a crucial role, with more efficient markets generally exhibiting narrower spreads. Finally, the number and competitiveness of market makers significantly influence spread size; more market makers often lead to tighter spreads.

Examples of Stocks with Wide and Narrow Spreads

Stocks of small-cap companies or those with low trading volume often display wide bid-ask spreads due to limited liquidity. Conversely, large-cap stocks traded on major exchanges typically have narrow spreads due to high trading volume and a large number of market participants. For instance, a thinly traded penny stock might have a wide spread, reflecting the difficulty in finding buyers and sellers, while a blue-chip stock like Apple or Microsoft usually exhibits a tighter spread due to high liquidity and continuous trading activity.

Bid-Ask Spreads in Different Market Conditions

Market volatility significantly impacts bid-ask spreads. During periods of high volatility, uncertainty increases, leading to wider spreads as market participants demand a larger premium for taking on risk. Conversely, low volatility periods are usually associated with narrower spreads due to increased confidence and reduced risk. News events, economic announcements, or geopolitical uncertainty can trigger substantial shifts in spread width.

Impact of a Large Order on Bid-Ask Spread

Consider a scenario where a large institutional investor wants to buy 1 million shares of a stock currently trading at $50 with a bid-ask spread of $0.10 ($49.90 bid, $50.00 ask). To fill this order quickly, the investor might need to increase the bid price, potentially widening the spread to $0.20 or more. This price increase incentivizes sellers to release their shares, but it also increases the cost of execution for the buyer.

Bid-Ask Spread Comparison of Three Stocks

Source: cheggcdn.com

| Stock | Monday | Tuesday | Wednesday | Thursday | Friday |

|---|---|---|---|---|---|

| Stock A (High Liquidity) | $0.05 | $0.06 | $0.04 | $0.05 | $0.07 |

| Stock B (Medium Liquidity) | $0.15 | $0.12 | $0.18 | $0.10 | $0.15 |

| Stock C (Low Liquidity) | $0.50 | $0.45 | $0.60 | $0.55 | $0.40 |

Impact of Order Types on Bid-Ask Prices

Different order types significantly impact bid and ask prices and a trader’s ability to execute trades efficiently. Understanding these effects is crucial for optimizing trading strategies.

Market Orders vs. Limit Orders

Market orders are executed immediately at the best available price, often leading to slippage, especially in illiquid markets with wide spreads. Limit orders, on the other hand, allow traders to specify a price at which they are willing to buy or sell. This reduces slippage but carries the risk of the order not being filled if the specified price is not reached.

Understanding the bid-ask spread is crucial when analyzing stock prices. The difference between these two prices reflects market liquidity and can impact your potential profit or loss. To gain a better understanding of historical price movements, examining the bac stock price history can be insightful. By observing past bid and ask prices, one can identify trends and potentially predict future price fluctuations, further refining your understanding of the bid-ask spread’s significance.

Strategic Use of Order Types to Minimize Slippage

Traders can strategically use limit orders to minimize slippage. For example, placing a limit buy order slightly above the current ask price can help secure a better execution price compared to a market order, particularly during periods of high volatility. Conversely, a limit sell order slightly below the current bid price can achieve a better outcome than a market order, particularly during periods of rapid price drops.

Influence of Large Institutional Orders

Large institutional orders can significantly impact bid-ask prices. The sheer size of these orders often necessitates gradual execution to avoid excessive market impact. This process can lead to temporary widening of the spread as the order is filled over time, influencing price movements and potentially creating opportunities for other traders.

Mechanics of Hidden Orders

Hidden orders, also known as iceberg orders, allow traders to place large orders while only revealing a portion of the total quantity to the market. This helps minimize market impact and prevent adverse price movements due to the order’s size. While beneficial for large traders, hidden orders can also reduce market transparency and liquidity.

Exploiting Narrow Bid-Ask Spreads with Limit Orders

Source: thestreet.com

- Identify a stock with a consistently narrow bid-ask spread, indicating high liquidity.

- Monitor the bid and ask prices closely, looking for opportunities where the spread temporarily narrows.

- Place a limit buy order slightly above the bid price and a limit sell order slightly below the ask price.

- If the market moves favorably, the orders will be filled, profiting from the small difference between the bid and ask prices.

- Manage risk by setting appropriate stop-loss orders to limit potential losses.

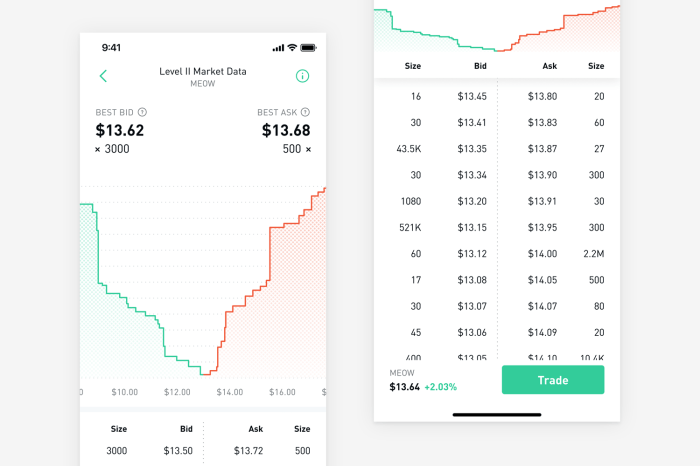

Bid-Ask Price and Market Liquidity

The bid-ask spread is directly related to market liquidity. A tight spread indicates high liquidity, while a wide spread signals low liquidity. Understanding this relationship is crucial for traders and investors.

Bid-Ask Spread and Market Liquidity

A narrow bid-ask spread indicates high liquidity, meaning there are many buyers and sellers willing to trade at prices close to the current market price. This makes it easier to execute trades quickly and efficiently with minimal slippage. Conversely, a wide spread indicates low liquidity, making it more challenging to execute trades without significant price impact.

Liquidity of Stocks with Tight vs. Wide Spreads

Stocks with tight spreads are considered highly liquid, allowing for easy entry and exit. These stocks typically have high trading volume and a large number of market participants. Stocks with wide spreads, on the other hand, are illiquid, making it difficult to buy or sell large quantities without significantly affecting the price.

Bid-Ask Spread as an Indicator of Market Depth

The bid-ask spread can be interpreted as an indicator of market depth. A narrow spread often suggests a deep market with a large number of outstanding buy and sell orders at various price levels. A wide spread suggests a shallow market with fewer orders, making it more susceptible to price fluctuations from even moderately sized trades.

Impact of Wide Bid-Ask Spread on Trade Execution

A wide bid-ask spread can significantly affect a trader’s ability to execute trades efficiently. The larger the spread, the greater the potential for slippage, meaning the trader may buy at a higher price or sell at a lower price than anticipated. This can reduce profitability and increase transaction costs.

Visual Representation of High and Low Liquidity Markets

Imagine a high-liquidity market represented by a deep order book with numerous buy and sell orders clustered tightly around the current market price, resulting in a narrow bid-ask spread. In contrast, a low-liquidity market would have a shallow order book with fewer orders spread thinly across a wider range of prices, leading to a significantly wider bid-ask spread.

Bid-Ask Price and Market Efficiency

The bid-ask spread serves as a useful indicator of market efficiency. Narrow spreads typically reflect efficient markets, while wide spreads often suggest inefficiencies.

Bid-Ask Spread Reflecting Market Efficiency

In efficient markets, information is rapidly disseminated, and prices accurately reflect all available information. This leads to narrow bid-ask spreads as buyers and sellers quickly agree on fair prices. Wider spreads often indicate market inefficiencies, where information asymmetry or other factors prevent prices from fully reflecting all available information.

Market Inefficiencies Reflected in Bid-Ask Spread

Source: investopedia.com

Examples of market inefficiencies reflected in wide spreads include infrequent trading, limited market participation, and the presence of information asymmetry, where some traders possess superior information than others. These situations can lead to larger discrepancies between bid and ask prices.

Role of Information Asymmetry

Information asymmetry, where some market participants have access to more or better information than others, can significantly influence the bid-ask spread. Traders with superior information may be willing to pay a higher price or accept a lower price, resulting in a wider spread.

Arbitrage Opportunities from Bid-Ask Discrepancies

Discrepancies in bid-ask prices across different exchanges can create arbitrage opportunities. Arbitrageurs can exploit these differences by simultaneously buying on one exchange at a lower price and selling on another at a higher price, profiting from the price differential. However, these opportunities are often short-lived and require quick execution.

Characteristics of Efficient and Inefficient Markets

| Characteristic | Efficient Market | Inefficient Market |

|---|---|---|

| Bid-Ask Spread | Narrow | Wide |

| Trading Volume | High | Low |

| Price Volatility | Relatively Low | Relatively High |

| Information Dissemination | Rapid and Efficient | Slow and Inefficient |

Algorithmic Trading and Bid-Ask Prices

High-frequency algorithmic trading (HFT) significantly impacts bid-ask spreads and market dynamics. Understanding its effects is crucial for navigating modern financial markets.

Impact of HFT Algorithms on Bid-Ask Spreads

HFT algorithms can both narrow and widen bid-ask spreads. By constantly monitoring and reacting to market changes, HFT algorithms can provide liquidity and improve price discovery, leading to tighter spreads. However, their rapid trading activity can also create volatility and exacerbate price fluctuations, potentially widening spreads during periods of uncertainty.

Algorithmic Trading and Price Volatility

HFT algorithms can contribute to price volatility through various mechanisms. Their rapid trading activity can amplify market reactions to news events or other triggers, leading to larger price swings. Furthermore, the complex interactions between multiple algorithms can create unpredictable market behavior and increased volatility.

Benefits and Risks of Algorithmic Trading’s Impact

The impact of algorithmic trading on bid-ask prices presents both benefits and risks. Benefits include increased liquidity, improved price discovery, and reduced transaction costs. However, risks include increased volatility, potential for market manipulation, and the creation of systemic risks.

Impact of Different Algorithmic Trading Strategies

Different algorithmic trading strategies have varying impacts on bid-ask spreads. Market-making algorithms, for example, generally contribute to tighter spreads by providing liquidity. However, other strategies, such as arbitrage or momentum trading, can contribute to increased volatility and wider spreads.

Ethical Concerns Related to Algorithmic Trading, Bid ask price stock

- Potential for market manipulation and price distortion.

- Lack of transparency and accountability in algorithmic trading strategies.

- Concerns about the fairness and equity of markets dominated by high-frequency trading.

- Risk of systemic instability due to complex interactions between algorithms.

- Difficulty in regulating and overseeing the rapid evolution of algorithmic trading technologies.

Q&A: Bid Ask Price Stock

What causes a wide bid-ask spread?

A wide bid-ask spread can be caused by low trading volume, high volatility, illiquidity, or a lack of market makers.

How does the bid-ask spread affect my trading costs?

The bid-ask spread represents the cost of executing a trade. A wider spread means higher transaction costs.

Can I always see the exact bid and ask prices?

Not always. Some orders, especially large institutional orders, may be hidden from public view to avoid market impact.

What is slippage, and how does it relate to the bid-ask spread?

Slippage is the difference between the expected price of a trade and the actual execution price. A wide bid-ask spread increases the likelihood of slippage.

How can I use the bid-ask spread to my advantage?

By identifying stocks with narrow spreads and using limit orders, traders can potentially minimize slippage and improve execution.