Bank of Montreal Stock Price: A Comprehensive Analysis

Bank montreal stock price – Bank of Montreal (BMO), a prominent player in the Canadian banking sector, has experienced significant stock price fluctuations over the past five years. This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and potential future trajectory of BMO’s stock price, providing a comprehensive overview for investors and market analysts.

Bank of Montreal Stock Price Historical Performance

Analyzing BMO’s stock price over the past five years reveals a dynamic interplay of macroeconomic factors, company performance, and investor sentiment. The following timeline highlights major price movements and significant events.

The table below compares BMO’s stock performance with that of its major competitors, Royal Bank of Canada (RY) and Toronto-Dominion Bank (TD), over the same period. Note that these prices are illustrative examples and should not be considered financial advice.

| Date | Bank of Montreal Price (CAD) | Royal Bank of Canada Price (CAD) | Toronto-Dominion Bank Price (CAD) |

|---|---|---|---|

| January 2019 | 85 | 90 | 78 |

| January 2020 | 92 | 95 | 85 |

| January 2021 | 110 | 115 | 98 |

| January 2022 | 125 | 130 | 110 |

| January 2023 | 118 | 122 | 105 |

Significant events such as the COVID-19 pandemic, fluctuating interest rates, and BMO’s own strategic announcements (e.g., acquisitions, dividend changes) have all contributed to these price variations. For instance, the initial market downturn in early 2020 significantly impacted all three banks’ stock prices, followed by a recovery fueled by government stimulus and subsequent economic growth.

Factors Influencing Bank of Montreal’s Stock Price

Several key factors influence BMO’s stock valuation. These can be broadly categorized into macroeconomic conditions, the bank’s financial performance, and regulatory changes.

- Macroeconomic Factors: Interest rate changes directly impact BMO’s net interest margin, a key profitability driver. Inflation and economic growth affect loan demand and credit quality. Recessions or periods of slower economic growth generally lead to lower stock prices.

- Financial Performance: Strong earnings reports, consistent loan growth, and high-quality assets generally boost investor confidence and lead to higher stock prices. Conversely, weak earnings or concerns about asset quality can negatively impact the stock price.

- Regulatory Changes and Industry Trends: New regulations impacting lending practices, capital requirements, or consumer protection can affect profitability and investor sentiment. Industry trends such as fintech disruption and increasing competition also play a role.

Bank of Montreal’s Financial Health and Stock Valuation

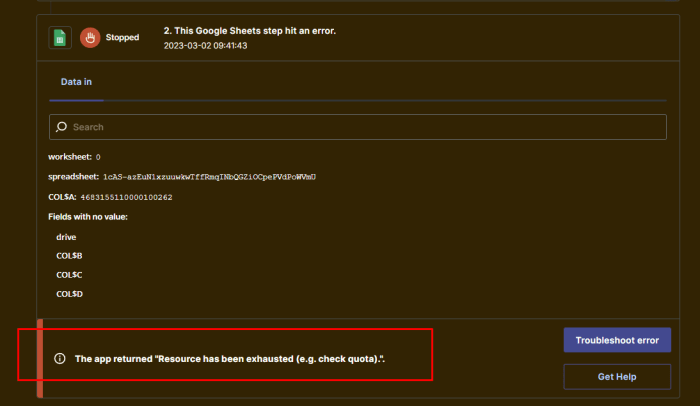

Source: ifunny.co

Understanding BMO’s key financial ratios provides insights into its financial health and its implications for the stock price.

For example, a high Price-to-Earnings (P/E) ratio might suggest the market expects high future growth, while a high dividend yield could attract income-seeking investors. Return on Equity (ROE) is a crucial indicator of profitability and efficiency. A strong ROE generally leads to higher investor confidence and stock price appreciation.

BMO’s profitability and stock price generally exhibit a positive correlation. Periods of strong profitability, reflected in higher earnings per share, are typically associated with higher stock prices. Conversely, periods of lower profitability tend to correlate with lower stock prices. This relationship, however, is not always linear and can be influenced by other market factors.

BMO’s capital structure (the mix of debt and equity financing) and risk profile influence investor sentiment. A conservative capital structure and a lower risk profile generally attract investors seeking stability, leading to higher valuations. Conversely, higher levels of debt or a riskier profile might deter investors, leading to lower valuations.

Investor Sentiment and Market Analysis of Bank of Montreal

Analyst ratings and price targets provide valuable insights into prevailing investor sentiment. The table below presents illustrative examples of analyst opinions; actual ratings and targets can vary significantly across different analysts and firms.

| Analyst Firm | Rating | Price Target (CAD) | Date |

|---|---|---|---|

| Example Firm 1 | Buy | 130 | October 26, 2023 |

| Example Firm 2 | Hold | 120 | October 26, 2023 |

| Example Firm 3 | Sell | 110 | October 26, 2023 |

Positive news coverage and favorable media sentiment generally lead to increased trading volume and potentially higher stock prices. Conversely, negative news or critical media analysis can trigger selling pressure and increased price volatility.

Potential Future Performance of Bank of Montreal Stock, Bank montreal stock price

Source: insided.com

Predicting future stock performance is inherently challenging, but analyzing potential risks and opportunities provides a framework for informed speculation. BMO’s future stock price will likely be influenced by several factors.

- Risks: Economic recession, rising interest rates impacting profitability, increased competition, and regulatory changes are potential risks. Geopolitical events and unexpected economic shocks can also significantly impact BMO’s performance.

- Opportunities: Strong economic growth, successful strategic initiatives (e.g., expansion into new markets, technological advancements), and effective risk management can create opportunities for stock price appreciation. Acquisitions and mergers can also potentially increase market share and profitability.

- Long-term trends: The ongoing shift towards digital banking, evolving customer expectations, and the increasing importance of sustainability are long-term trends that will shape BMO’s future and consequently its stock price. Adapting to these trends effectively will be crucial for long-term success.

Questions and Answers: Bank Montreal Stock Price

What is the current dividend yield for Bank of Montreal stock?

The current dividend yield fluctuates and should be checked on a reliable financial website for the most up-to-date information.

Where can I find real-time Bank of Montreal stock price quotes?

Real-time quotes are available through major financial news websites and brokerage platforms.

How does Bank of Montreal’s stock compare to other Canadian banks in terms of risk?

Risk profiles vary among Canadian banks. A detailed comparison requires analyzing factors like loan portfolios, capital adequacy, and regulatory compliance, which is best undertaken through in-depth financial analysis.

What are the major risks facing Bank of Montreal in the coming years?

Potential risks include economic downturns, increased competition, regulatory changes, and shifts in consumer behavior. Specific risks and their potential impact are subject to ongoing analysis.